Thanks Japan

Bargain or burden?

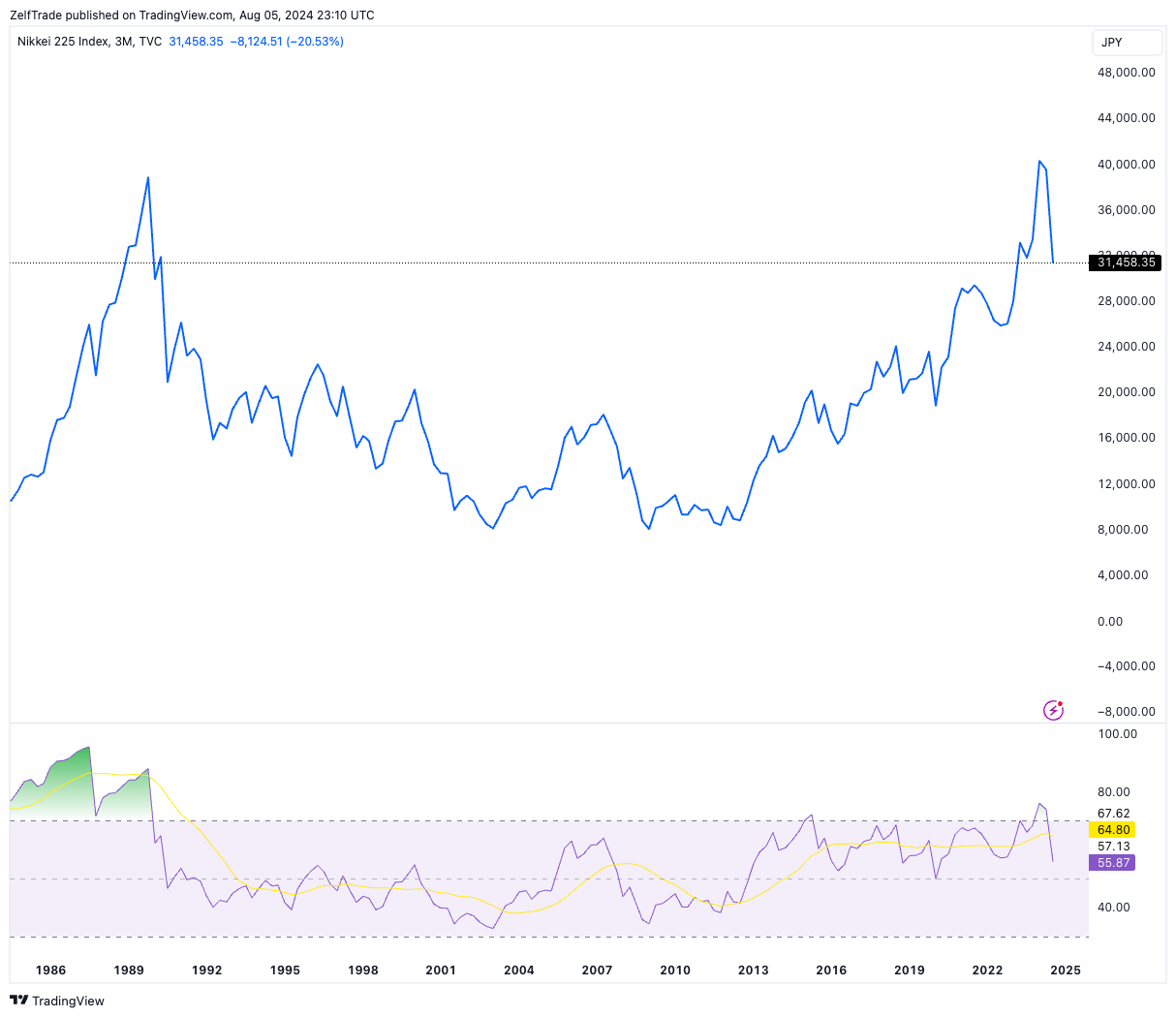

It all started with Japan's index Nikkei 225 dropping 12.4% on Monday. The largest daily decline since the Black Monday crash of 1987. US 24h trading market then continued the selling pre market open and today at least six trading platforms halted trading (Citi, Fidelity, E-Trade, Vanguard, TD Ameritrade and Charles Schwab) due to "system failure." South Korea also halted all sell orders.

Stock markets around the world are crashing due to the the sharp rise in the JPY/USD which caused a massive uncoil of Yen carry trade positions which contributed to the sharp decline in US stocks. Brief explanation:

- Last week the Bank of Japan (BOJ) hiked interest rates to ~0.25% in their second rate hike since 2007, ending negative rate policy.

- For years, traders took advantage of these ultra low rates by borrowing Japanesse Yen (JPY) at low interest rates, converted them to USD and then used this to buy US stocks.

These traders are now in deep shit. They will now pay higher interest for the JPY borrowed plus the huge forex losses due to JPY strengthening against USD. Not only this but the USD assets they are now holding may not be enough to repay their JPY debt.

USD/JPY trading analysis

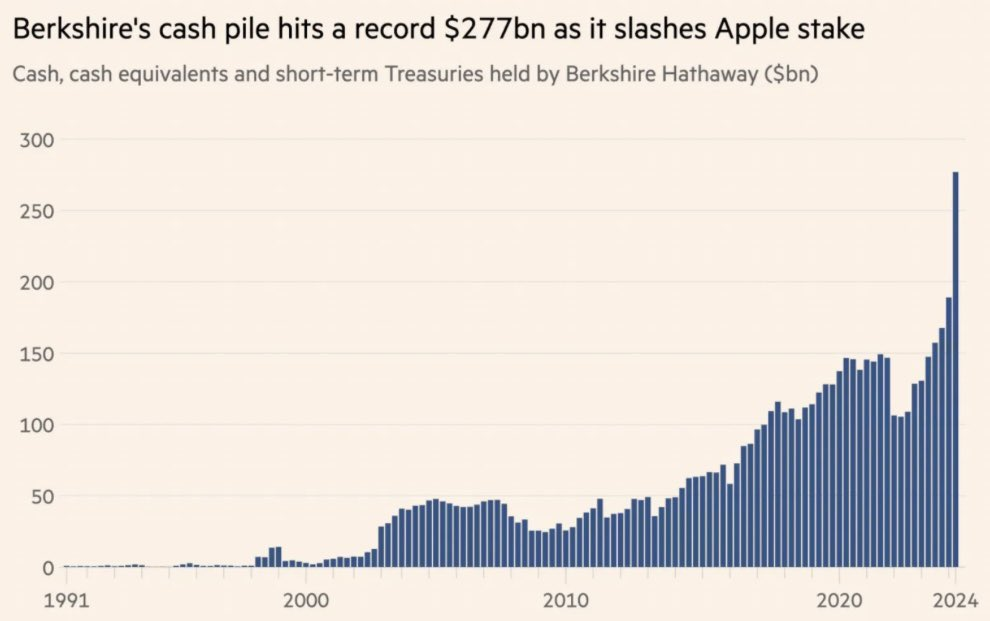

We should've known better as the warning signs were there. Not only in the Japanese rate hike but in Warren Buffet's last week sell order of more than half of Berkshire's holding's of Apple, worth around $84 billion which lead to Berkshire's biggest cash pile holding position they've ever had. Warren knew right away.

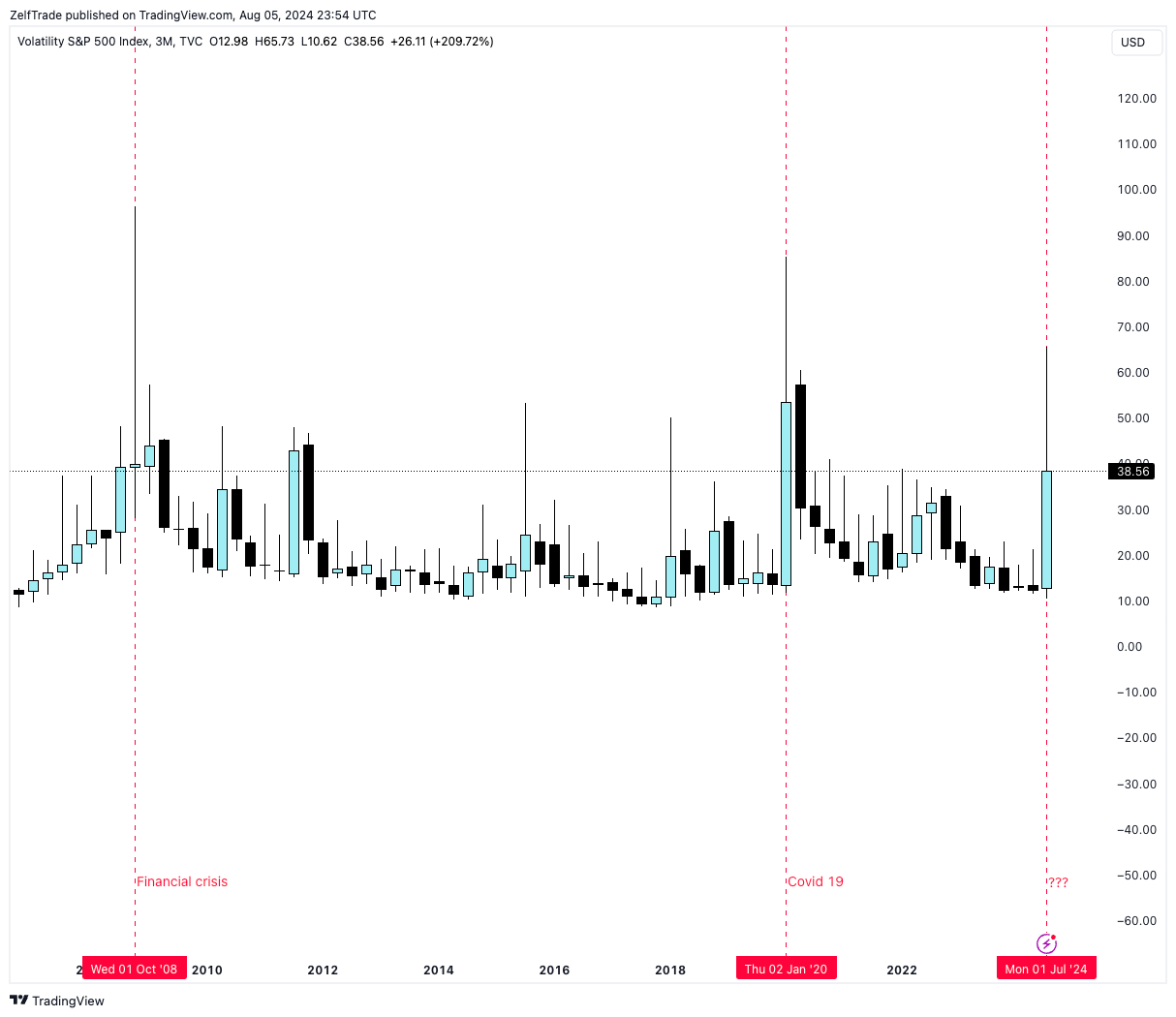

Market crashes have only existed when the Volatility Index (VIX) has broken above 50, today we hit 65. History doesn't always repeats itself but it often rhymes.

Traders are facing big losses and margin calls. They are selling their US stocks to raise USD and convert them back into JPY to pay back their loans. Short term this can lead to more selling pressure on markets across the world. Plus the US political uncertainty and the Middle East war escalations are an additional fear factor.

Manage your risk accordingly as this continues to unfold but from an investor's standpoint, this type of short term crisis and panic across the globe gives us the opportunity to better position ourselves in the markets. We are now able to buy US quality stocks or crypto asset that we truly believe in, at a bargain prices. Play smart and don't go all in right now. We'll keep updating our macro and short term trading entries as always. There's no better trading strategy than dollar cost averaging your way in. "Be fearful when others are greedy and greedy when others are fearful" -Warren Buffet.