The Road to Recovery: Crypto's Q4 Potential and RWAs

As the market gains momentum, artificial intelligence (AI) is emerging as a significant driver, highlighted by strong performers like $FET and $TAO. Layer 2 solutions are also thriving, with $IMX standing out among the top performers. Meanwhile, the meme sector continues to yield consistent results, featuring various coins that have achieved triple-digit returns, although older coins like SHIB and DOGE are lagging behind. One sector that has yet to break out is Real-World Assets (RWAs), which presents an opportunity worth monitoring as we approach the end of the month.

We are now entering the last quarter of the year. With the post-halving accumulation phase nearly complete and approximately $16 billion set to be returned to FTX customers in cash, there is renewed optimism for this quarter, both historically and financially.

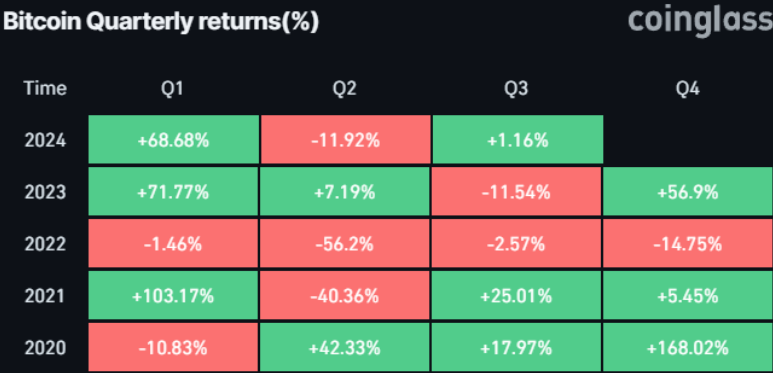

Here are some key points regarding Bitcoin’s performance in the last quarters over the past few years:

- 2020: Bitcoin gained significant momentum in Q4, rising from around $10,700 in October to approximately $28,900 by the end of December.

- 2021: The upward trend persisted, with Bitcoin hitting an all-time high of about $69,000 in November. Although the price fluctuated, it ended the year strong, closing around $46,000.

- 2022: The last quarter proved challenging, with Bitcoin experiencing a decline due to market corrections and broader economic factors, dropping from approximately $19,500 in October to around $16,500 by December.

- 2023: Q4 marked a pivotal turnaround for Bitcoin, opening at $26,900 in October and closing at $42,300 by the end of December.

The only negative quarter was in 2022, when FTX filed for bankruptcy. Had that not happened, Bitcoin could have closed the quarter in the green, marking four consecutive positive quarters.

With this historical context in mind, we now see a fresh influx of capital returning to the crypto market due to FTX’s cash distributions. Typically, creditors are paid in cryptocurrency, which often leads to selling pressure as they rush to recover their funds. However, this time around, cash distributions means no selling activity, which bodes well for the market. While some creditors may choose to hold cash (a less strategic move), many will likely reinvest in cryptocurrency.

As a result, a significant portion of this capital is expected to flow back into the crypto market, acting as a catalyst for growth in Q4. Although more support will be needed for a complete market turnaround, even a modest percentage of the total distributed amount can exert positive buying pressure.

Most of the affected FTX clients are everyday cryptocurrency investors, suggesting that a considerable amount of the recovered stablecoins will likely re-enter the market. A large share of these funds will certainly be directed toward Bitcoin ($BTC) and leading altcoins like Solana ($SOL) and Binance Coin ($BNB). However, I believe investors will also be interested in newer or trending coins rather than older altcoins from previous cycles. This is why RWAs are particularly compelling right now, as they are on the verge of breaking out alongside other hot crypto categories.

Top 10 Real-World Assets (RWAs)

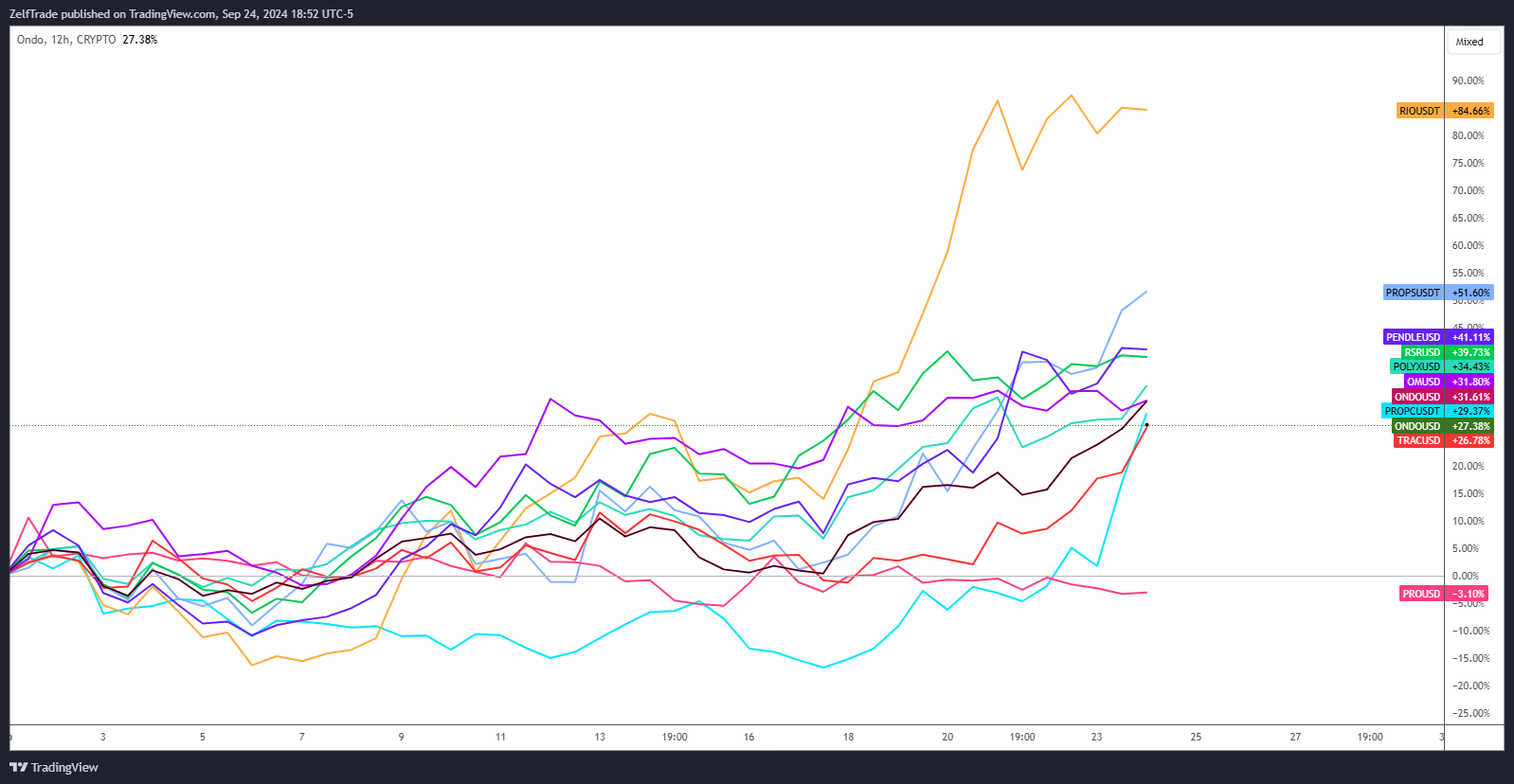

Currently, I am tracking the top 10 RWAs by market capitalization. While they have lagged compared to other sectors, they are still worth considering. If the RWAs index can reclaim the 1700 data level, it will likely shift market sentiment in their favor, and they are not far from achieving this.

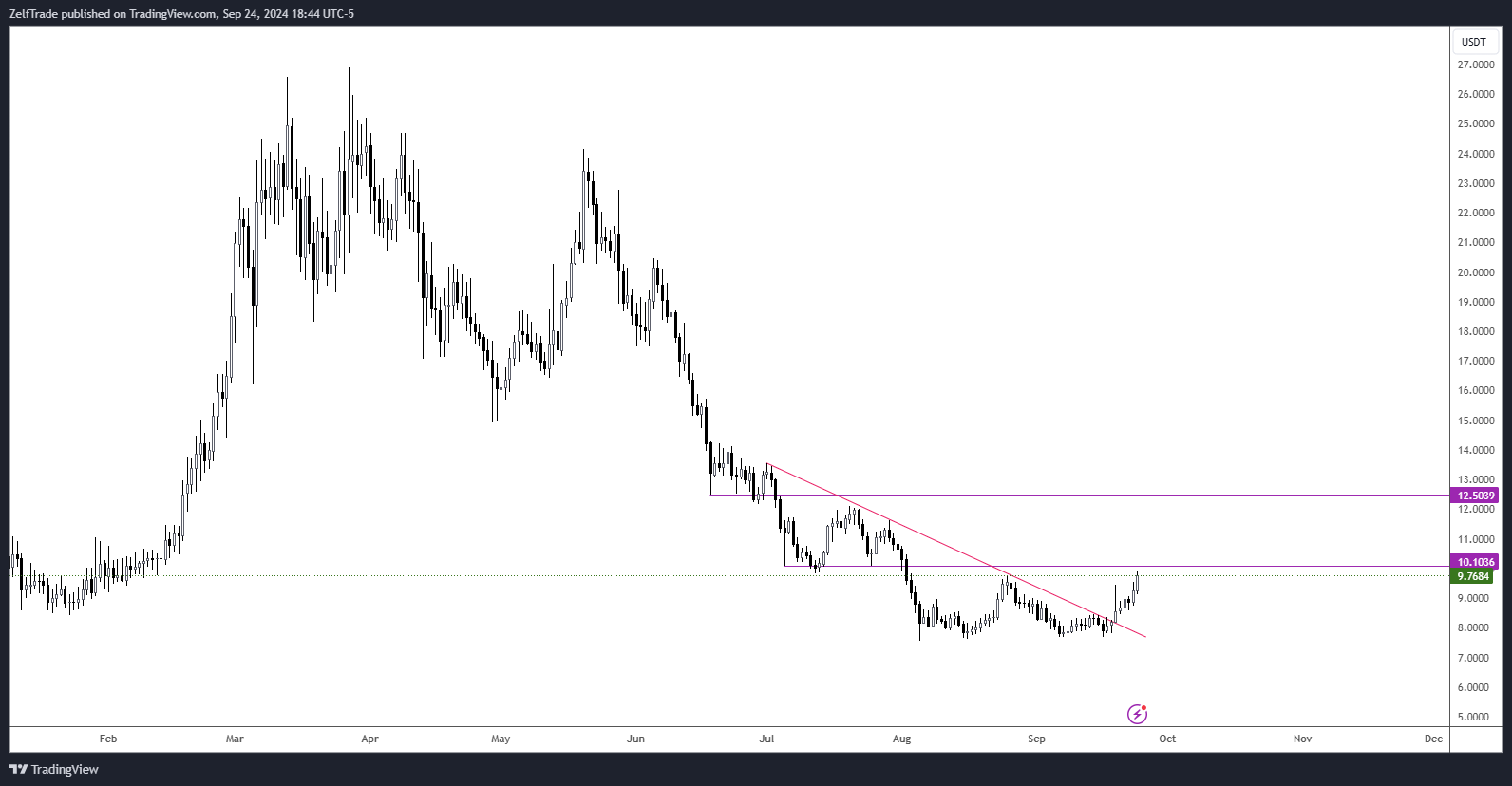

My main interest lies in mid- to lower-cap coins, which are at similar levels to those seen in the AI and meme sectors before their respective breakouts. This segment has the potential for substantial gains once it reclaims the 10-point zone. I have included several key coins within the $50 to $500 million market cap range in this analysis, understanding that these figures may fluctuate as certain coins move outside of these levels.

Overall, the most narrative-driven sectors should be the focus this quarter. With RWAs lagging behind, they present a strong opportunity for capitalizing on upcoming movements compared to other sectors.