$ONDO - Exclusive Coin Picks & Market Outlook

Starting now, I’ll be posting exclusive coins that I believe have the potential to outperform the broader market.

Macro Market Update: Inflection Point

We are still at a critical inflection point, with two possible scenarios:

- Bearish: A breakdown that erases recent crypto gains, leading to a bear market.

- Bullish Continuation: Accumulation followed by one last leg up—but only if BTC reclaims the yearly open.

Previously, I discussed the possibility of topping out—but for now, I am maintaining a cautiously optimistic stance. BTC is still within a multi-month trend and continues to retest key levels, keeping it on track. However, a break below $75K-$76K would force me to re-evaluate my outlook.

For deeper insights, check out my last article on OTHERS, BTC.D, and stablecoin liquidity.

$ONDO – A New Setup Begins

🚀 Track the live price here:

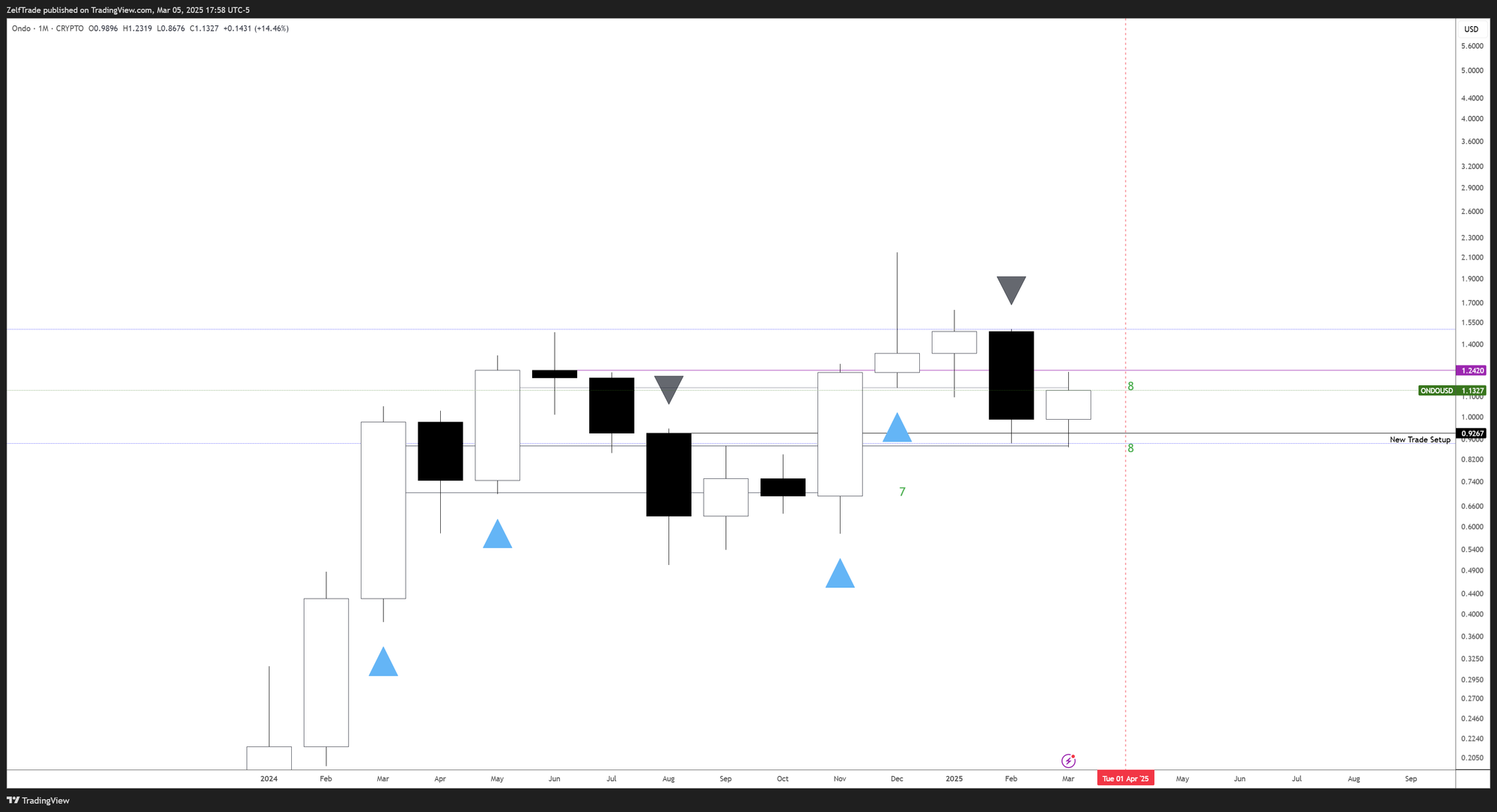

Macro View: Hidden Strength

ONDO is forming its first major consolidation since launch, but we can still extract key insights:

- Hidden strength: The chart is adding more bars to consolidation while holding above the previous mode at $0.70.

- No full retest: Unlike other alts, ONDO hasn’t revisited previous key levels.

- Key support: Holding above $0.85 increases the chances of a strong bullish breakout.

- Tight range = big move: If the monthly candle closes within this range, it could trigger an expansion bar in April—as tighter ranges tend to attract liquidity.

📉 Chart:

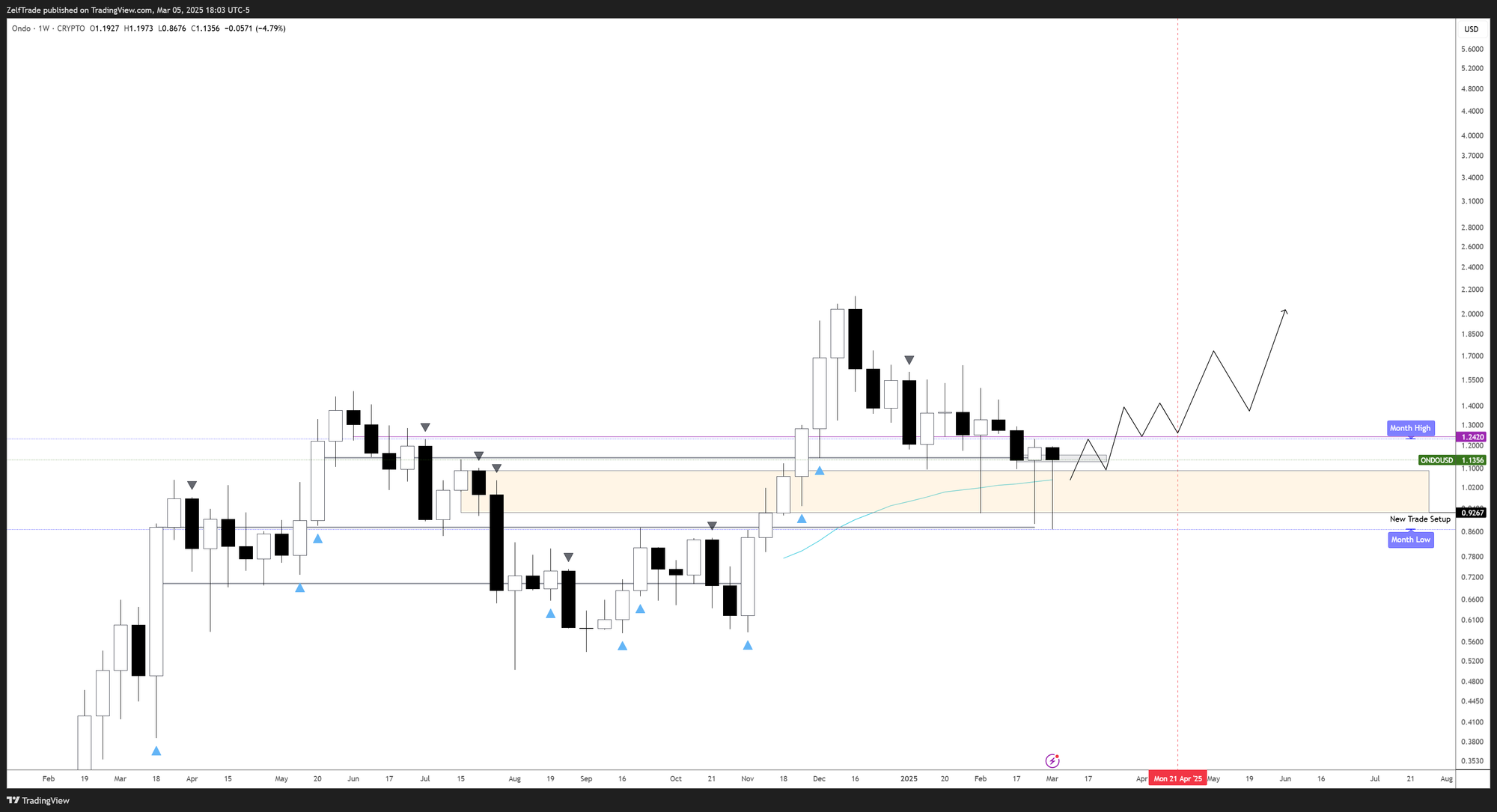

Weekly Outlook: Patience is Key

- The weekly trend remains down, with a potential expiration around April 21st.

- However, lack of follow-through to the downside suggests accumulation near sub-$1 levels.

- Price is aligning with the POC from the previous 8-bar mode and Weekly breaker.

💡 Key zone to hold: The yellow block on the chart—if it holds, even for another 4 weeks, this setup stays intact.

⚠️ Mental game: Time-based consolidations require patience. If the downtrend gets invalidated ($1.28-$1.30) or doesn’t break lower, we could be in for a higher push soon (Q2).

📉 Chart:

What I’m Watching in Q2

- Bullish signal: If ONDO holds above $1.24 later in Q2, things could get interesting.

- Current strategy: Accumulating in the mid-$0.90s zone with an exit if price trades below $0.90.

- Weekly vs Monthly: This setup is still against the weekly downtrend, but I'm banking on the monthly trend validating after Q1.

📉 Chart:

Final Thoughts

For now, we wait and track ONDO’s range. The breakout levels are clear:

- Above $1.24 → Bullish continuation, potential for new highs.

- Below $0.90 → Setup invalidated.

Anything in between? It’s range-bound trading territory—still valuable if you’re looking to trade within tight ranges.

Let’s see how this plays out. 🚀 Stay sharp!