Mag7 Tech Stocks - Edition #10

Mid-week update.

Nvidia (NVDA) - bullish

We are currently at the ideal long entry, small market buy at current price will be smart. A retrace continuation towards $100 is still in play so DO NOT GO ALL IN. Dollar cost averaging your way in. Hopefully we see a strong reaction on lower time frames otherwise we might be in for a bigger retrace.

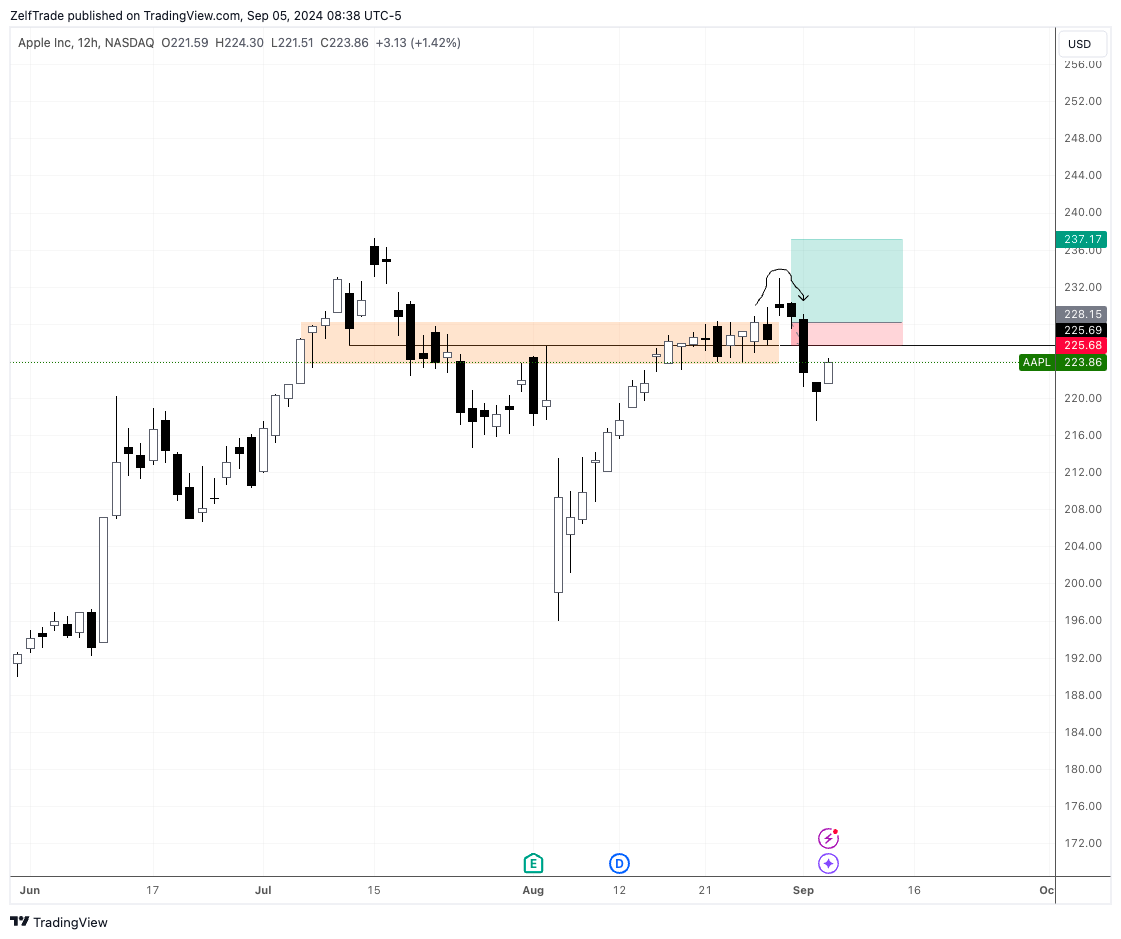

Apple (AAPL) - bearish

Unfortunately we got stopped out on this one. It was a clean break and retest. Worth the RR, -1% loss and on to the next one. No rush in jumping in right now although it does look like we could have a dead cat bounce toward $228.

Alphabet (GOOGL) - neutral

Also stopped out here. Structure wise we had higher highs and higher lows, everything indicating a short term reversal but unfortunately we broke below our key level invalidating our trade idea. Great RR as well, took a -1.5% loss and on to the next one. Similar to Apple, looks like a dead cat bounce's on its way, just not my cup of tea.

Amazon.com (AMZN) - neutral/bearish

Price action remains bearish. The only long trade here will be upon a break above $179 indicating bulls are back. Daily chart must close above this key level. Other than that, price action looks horrible and quite uncertain.

Tesla (TSLA) - neutral/ bullish

$205 was the temporary bottom. Today and/or tomorrow's daily close are crucial. If we close the daily chart above $228 then the bullish trend reversal is confirmed and we will be looking for entries. Other than that there is no point in jumping in right now as price is standing at resistance level.

Microsoft (MSFT) - bearish/ neutral

We are at a critical level. A sweep of the $400’s is still in play but a strong bullish reaction is expected. If we lose $400 there is no interest in staying long here.

Meta Platforms (META) - bearish

Bearish retrace is on its way. $490 - $480 might be a great entry.

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.