Mag7 Tech Stocks - Edition #24

New Year's Macro Outlook...

Quite the run for the Roundhill Magnificent Seven ETF $MAGS as December kept making higher highs. Now for the first time in a while the 3 day chart just printed a bearish signal with possibility of a retrace toward $51's. If we do get this retrace, this will be the perfect long repositioning point as MACRO structure remains BULLISH.

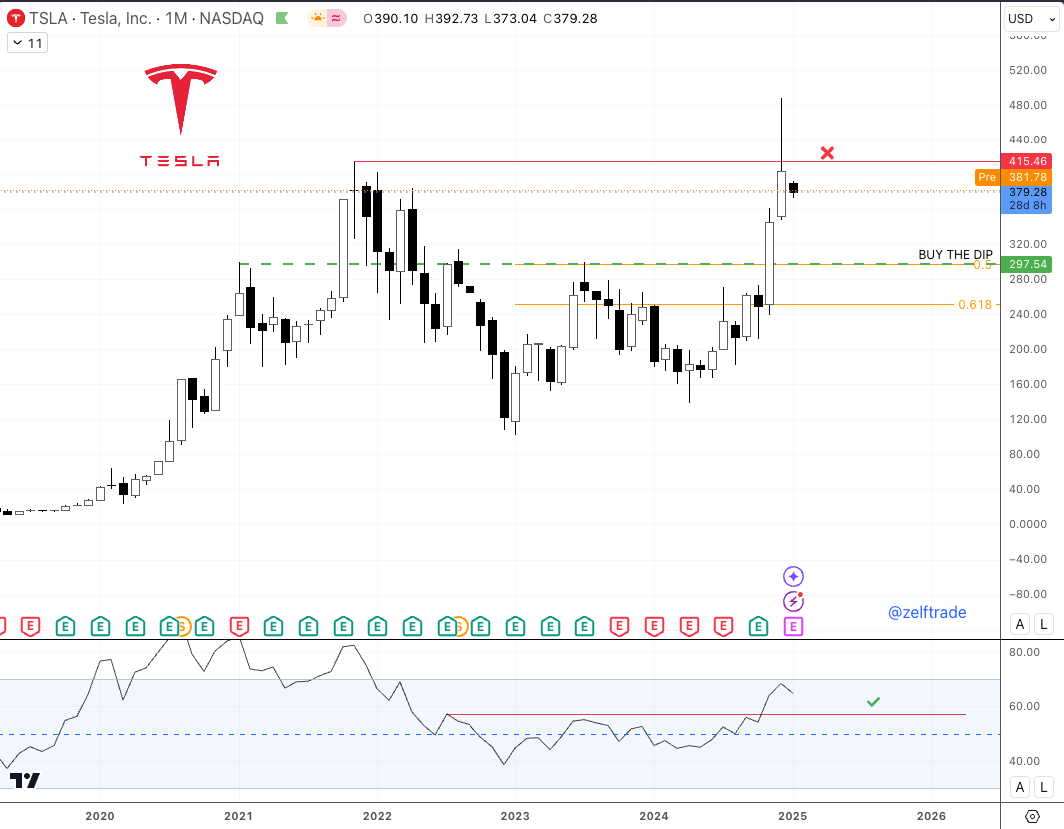

Mixed feelings on Tesla $TSLA after the huge pump to new all time highs but weak monthly close. The fact that price wasn't able to close above previous all time high, and printed a huge selling wick signals deceleration in bullish momentum and lack of strength. If, price retraces towards $300 - $200's which is a steep retrace but certainly possible, this will be the IDEAL RE-ENTRY.

MACRO remains BULLISH as price kept making higher highs, lower lows and monthly RSI is also making a new higher high and is now trading above the 50. In other words, I see Tesla going to $1k + rather soon so don't let short term price action shake your macro conviction.

Nvidia $NVDA looks like the bottom is in and upon today's weekly close, if price closes above previous weekly candle high, that will trigger the next leg up with first target of $180. Next key level to look for is previous all time high but for now, looks like we might have a temporary bottom.

Alphabet $GOOGL price kept making higher highs and higher lows which is certainly BULLISH. But at the same time December just printed a weak monthly close as price was unable to close above previous all time high. Last time price made a new all time high back in January 2024 and was unable to close above, price retraced -14% before further upside.... If we get the same percentage retrace now, that will put us at an entry of around low $170's which has confluence with the 50 fibonacci retrace from the latest swing and December monthly lows. It doesn't get better than this.

Amazon $AMZN price is well above previous all time high. Time at mode monthly bullish trend remains active with next target of $280 and expiry set for July. At the moment all macro charts are strong although they might be showing some selling pressure as bearish wicks have been formed. It might be worth being cautious as many other tech stocks might be getting some retraces and this one could follow through.

Apple $AAPL almost + 5% ROI after previous two long entries but exited at break even as price completely retraced all the gains made.

MACRO MONTHLY time at mode trend remains ACTIVE. Next target of $275 by June is on the way nonetheless short term we may have yet another entry chance. December monthly candle too closed with a bigger selling wick signaling possible weakness. Any retrace toward the green box is a BUY.

Microsoft $MSFT back to square one on the 2 week chart but the trade remains active. Price is currently at the perfect entry as long as $406 is respected price will trend higher.

On the other hand, the monthly chart might be telling a different story. RSI keeps making lower lows and the December monthly candle closed with a HUGE selling wick. Lots of indecision in price action.

Meta Platforms $META we are in. As long as price remains above $550 we will trend higher. There's a 2 week and a monthly time at mode trend active with expiry on February and April 2025. May price keep trending at around this range? yes so dollar cost average your entry, be patient and zoom out.

Previous report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.