Mag7 Tech Stocks - Edition #23

Morning Brew ☕ Everything's green 🟢 🟢 🟢

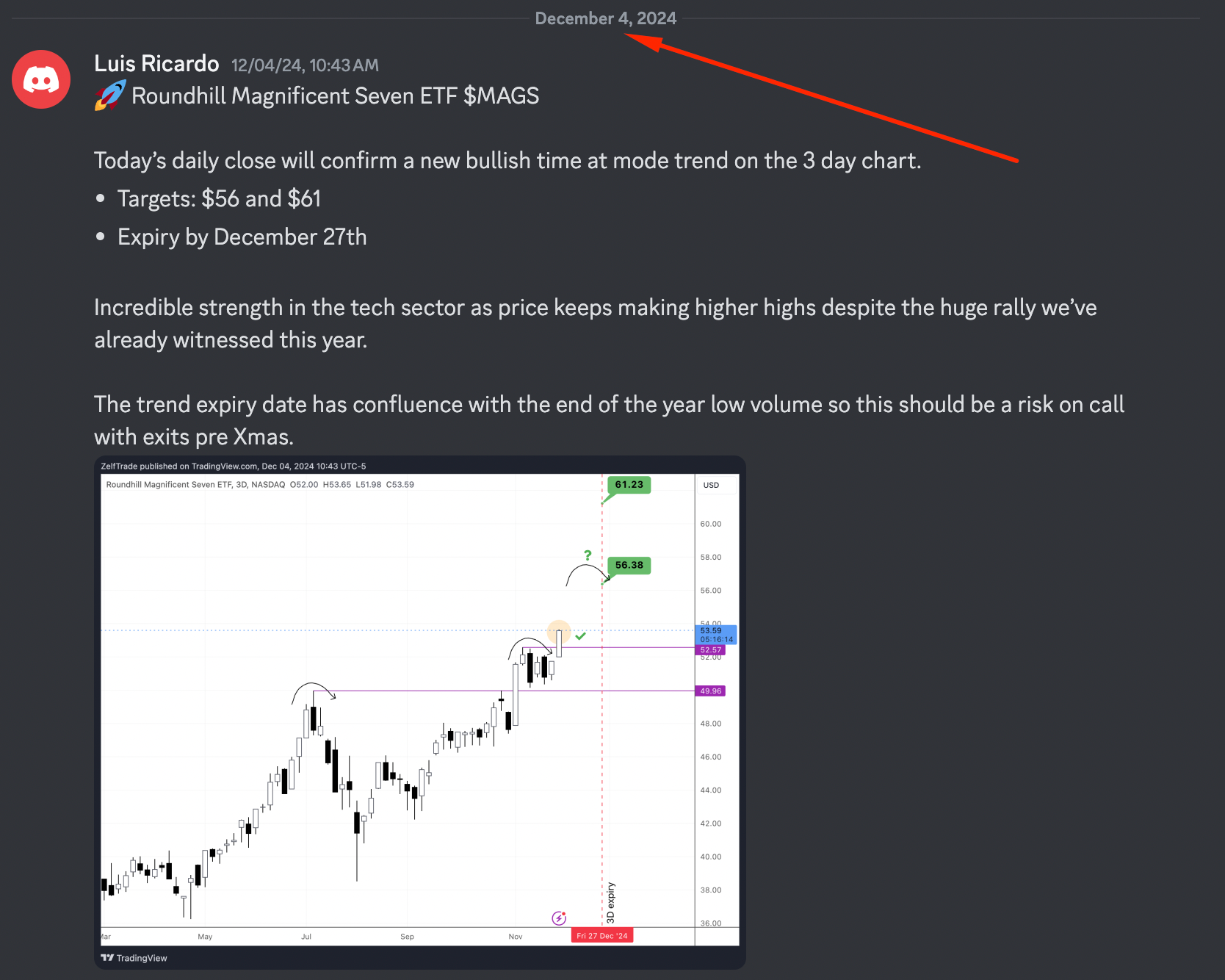

The tech sector's ON THE RUN! 6 out of 7 stocks are BULLISH. Roundhill Magnificent Seven ETF $MAGS had a perfect pump from previous entry signal as price printed a clear bullish trend confirmation. As posted on December 4th, the 3 day chart printed a bullish engulfing and range expansion candle above previous highs. This together with our time at mode methodology signaled a bullish trend confirmation with targets of $56, which we already hit and the second target of $61 which looks like we are on the way! As of right now there's no need to step off as price keeps showing strength just be careful on which stock you pick and what price you decide to jump in.

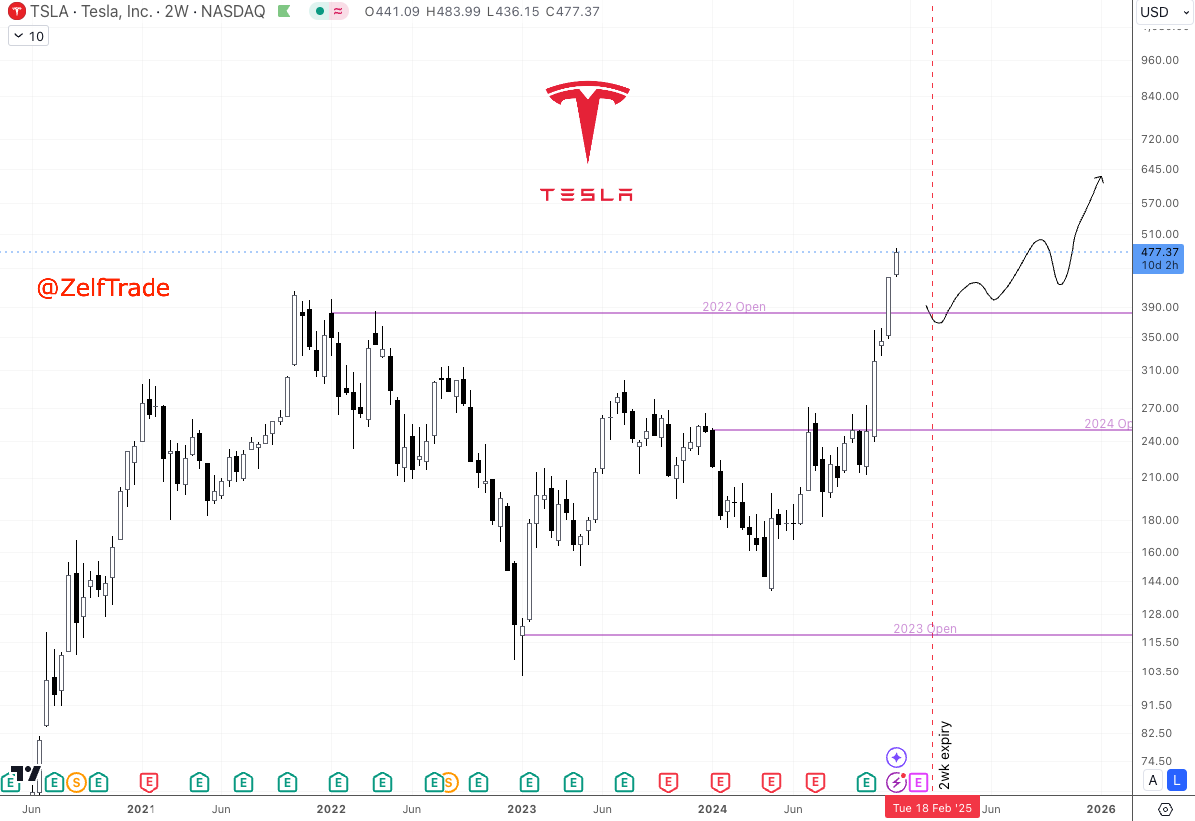

Tesla $TSLA certainly leading the way and giving no room for bystanders to jump in. Price just kept pumping and keeps making new all time highs by the minute. There is an active bullish trend set to expire mid February so we expect price to keep on surging. This stock will go over $1,000 + per share that's for sure so no need to OVER TRADE. The new ideal entry just became $390's IF we get that retrace but there is NO SIGNS OF WEAKNESS at the moment.

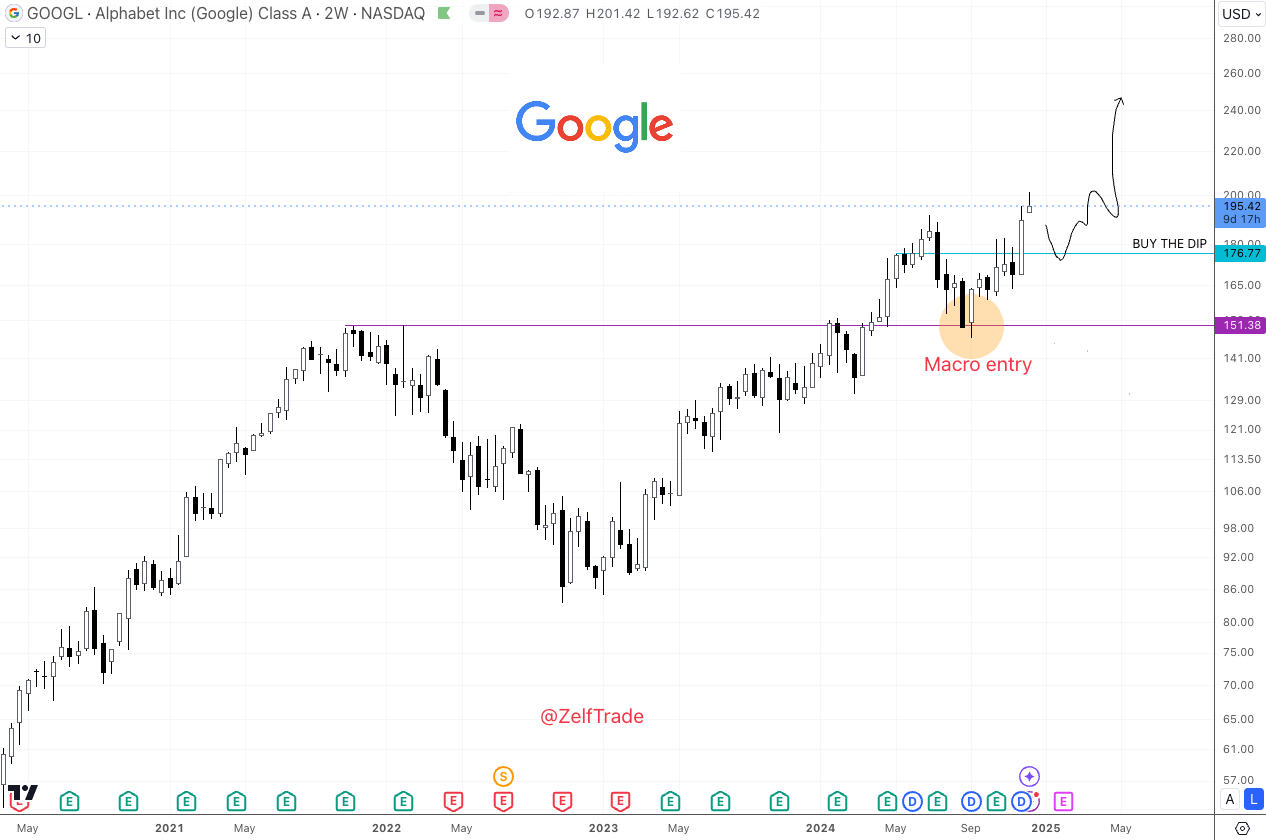

Alphabet $GOOGL has been ON THE RUN after the news of "Google's breakthrough" of $willow (Quantum computer). Then $QRL did a 3x in market cap within a week. Quite the Pump. As previously mentioned our macro entry was at around $150 which we hope you all took advantage of. As of right now, any retrace toward $180 is a BUY. DO NOT MISS OUT AGAIN. This is one of the undervalued stocks from the MAG7.

Absolutely killing it on Amazon $AMZN as well. We are almost +16% from entry and our first target just got hit. There's no weakness signs so far. Small profit might be taken but hoping for a continuation to our next target. Everything looks bullish so far but price does need to close the week strong. We'll keep monitoring and update if needed.

Apple $AAPL is about to confirm a MACRO BULLISH trend on the monthly timeframe. Upon December's monthly close, which already looks extremely bullish, will confirm this macro Bullish Time at Mode trend with first two targets of $275 and $332 by May 2025. As of right now there is no sign of weakness but bellow are ideal entries in case we do get a LTF retrace.

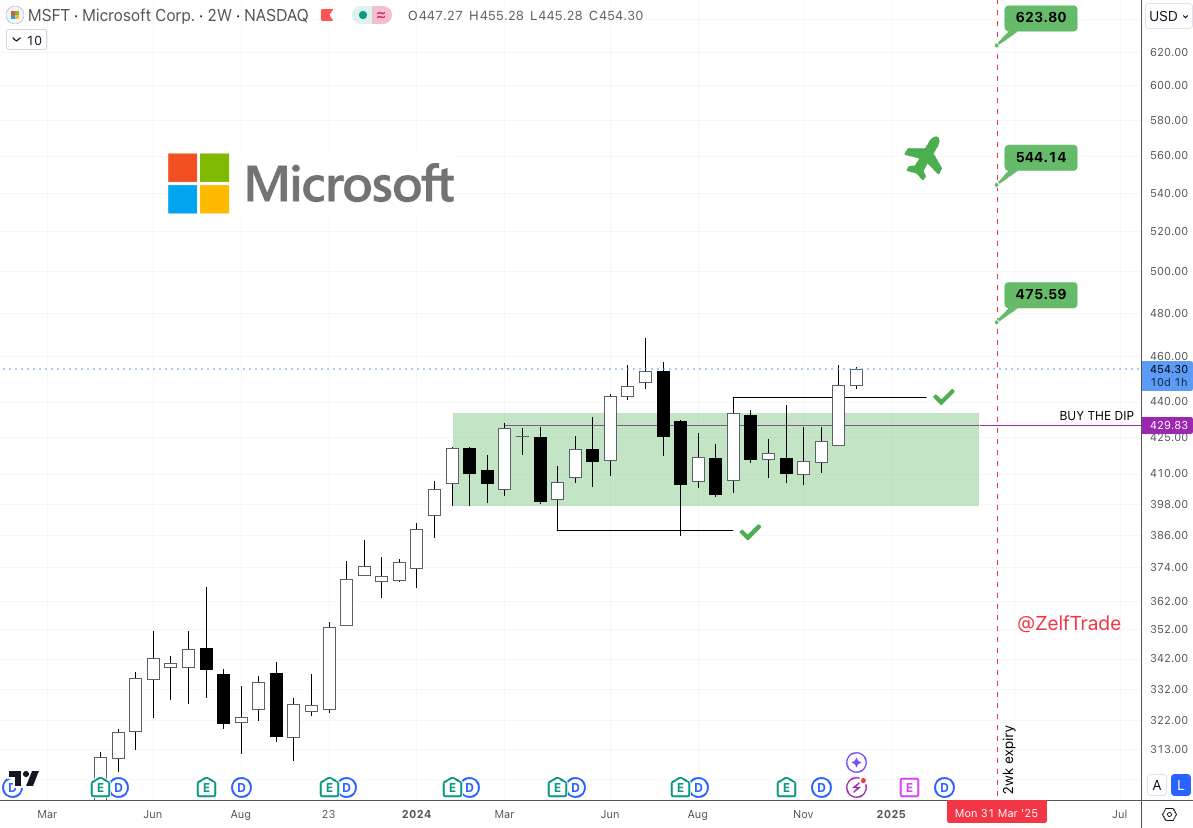

Microsoft $MSFT WE ARE IN GUYS! Almost 6% in profit from last entry and we now have MACRO confluence. There is a bullish Time at Mode trend that just confirmed on the 2 week chart with targets of $476, $544 and $624 aprox. this stock is looking quite bullish right now but if we do get some type of retrace toward $430ish we BUY THE DIP.

Meta Platforms $META too just confirmed another macro bullish trend. This is just insane. There is a 2 week Time at Mode confirmation with targets of $700, $760 and $830 by February 2025. Not only this but there's also an even higher timeframe Time at Mode bullish trend confirmed on the monthly chart which expires on April 2025. If we get the divine retrace of around $480's we BUY THE DIP and wouldn't hurt simply dollar cost averaging your way in as such a steep retrace could not even happen.

And finally we have Nvidia $NVDA which is the lagging 7th tech stock. After such a massive run over 2024 no wonder why it is stalling. People are simply taking profits and doing some capital rotation towards other stocks with more momentum behind.

There's actually a bullish Time at Mode confirmed on the monthly timeframe with targets of $180 and $280 by March 2025. Price is at a critical level, based on the weekly timeframe it could very well pump from here but there is no lower timeframe strength at the moment. On the other hand, it could also continue to drop toward $120ish and as long as we see a strong bullish reaction from there, we should be good. Bullish structure remains intact, its just a bit to slow at the moment.

Previous report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.