Mag7 Tech Stocks - Edition #22

Roundhill Magnificent Seven ETF $MAGS bullish time at mode trend has expired and is now in accumulation phase for a new trend. As previously mentioned, December tends to be a slow moth as people lock in their profits and go off on holidays so better risk off and/ or adjust exposure. Nonetheless this time might be different as there seems to be incredible strength in the markets. Lets pay attention to the key levels below.

Short term safer bet will be to short weakness at the range highs of $52's and long at $50's nonetheless the best macro play will be to wait for a strong higher timeframe chart close above $52.6 for further upside or a close below $50 for a steeper retrace.

🚀🚀🚀 Tesla $TSLA - MACRO F'N BULL

Insane monthly close and chart looks like it wants to keep going for a new all time high soon. IDEAL re-entry for any bystander should be at around $260's which might seem to good to be true but steep retraces DO happen and price action will completely remain bullish if it does.

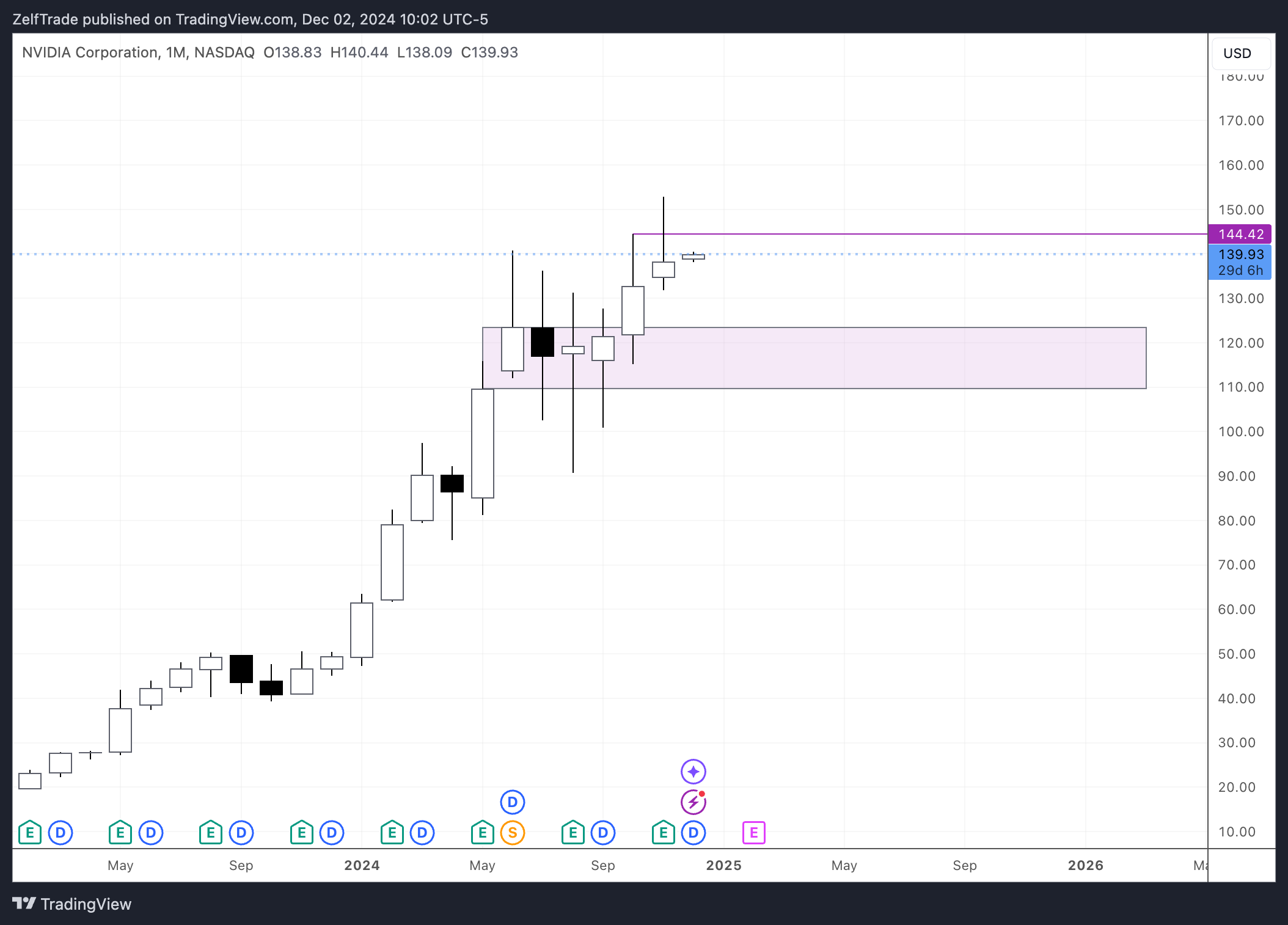

Nvidia $NVDA - Neutral

-2% stopped out from previous play. Price was unable to get a strong close above previous highs and completely retraced back to our stop.

Monthly chart lacks strength. The same type of candle close below previous high that we saw in the daily chart above is now being printed in a monthly chart which has way more relevance in macro price action. The hype run might be running out of fuel and we might have a retrace towards $100's.

🚀🚀🚀 Alphabet $GOOGL - Macro Bull

+5% profit from last trade take profit area as price was unable to reclaim above $180 and simple plunged right after.

Monthly chart looks beautifull. Macro looks quite bullish but in the coming months, a retrace towards $150 is still in play and might be the ideal long entry.

🚀🚀🚀 Amazon.com $AMZN

+6% up from entry as price did pumped quite quick from entry. This one has a time at mode bullish trend active till mid December with price targets of $231 and $253. A strong close above previous high is key for bullish continuation.

Apple $AAPL - Bullish

Price is currently breaking up. A strong daily close today above previous high will ignite further upside but price already looks good and a small market buy at current price might be worth it.

Meta Platforms $META - MACRO BULL

This on has a monthly time at mode bullish trend confirmed with targets of $630 and $780 set to expire on April 2025th.

Short term on the other hand looks bearish but last week's weekly chart closed with a bullish engulfing bar signaling strength. Ideally we want to enter upon a break a previous highs or upon a retrace to $570's.

Microsoft $MSFT - Bullish

Daily chart is about to turn bullish. Today's close will be key, ideally we want price to close above $431 for better confluence But even a small market buy at current price might be worth it.

Previous report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.