Mag7 Tech Stocks - Edition #20

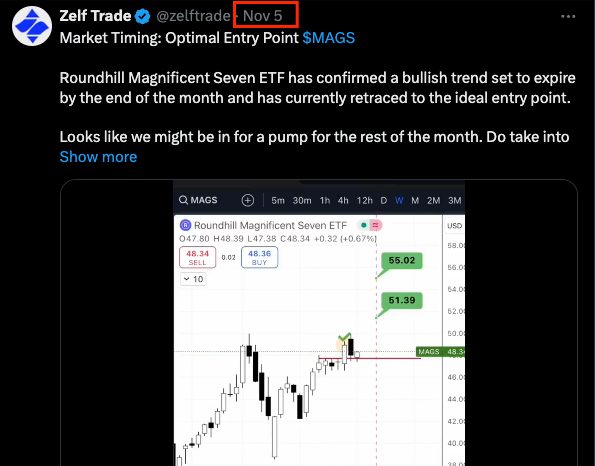

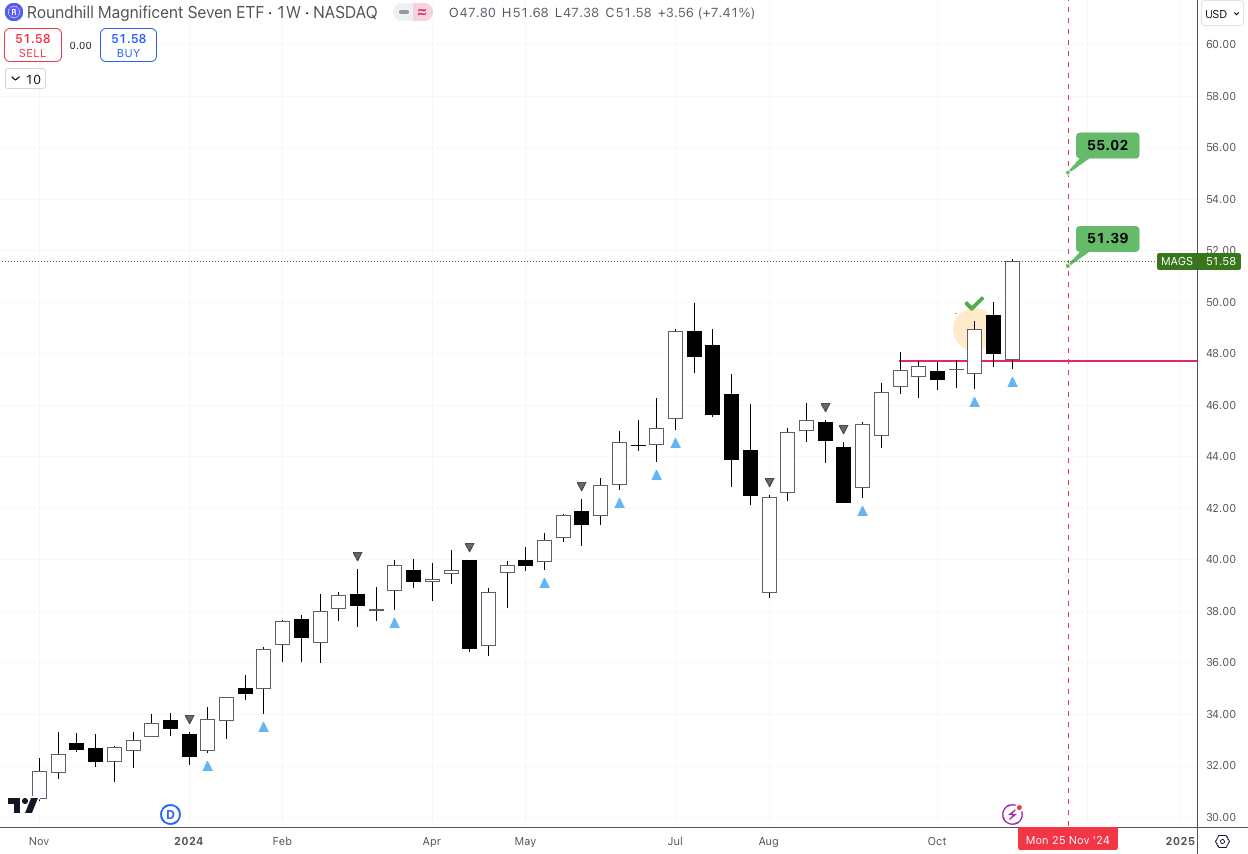

Tuesday's long call perfectly hit as Roundhill Magnificent Seven ETF $MAGS had a massive pump after Trump's win. It was indeed the perfect retreca before continuation. As we mentioned in our previous report, there is an active bullish trend set to expire by the end of November so embrace the pump and remember that the trend is your friend.

🚀🚀🚀 Tesla $TSLA - MACRO F'N BULL

Last week's price action marked the new bottom for now. As time passes by Tesla's stock will get more expensive to get. As for now, with such a bullish momentum behind any retrace towards $260's to mid $240's is a long entry.

🚀🚀🚀 Nvidia $NVDA - BULLS ARE BACK

Weekly bullish expansive and engulfing bar just printed. There is a bullish time at mode trend that has just been triggered with targets of $154 and $269's at first. Expiry is set for the end of November as well so everything is aligning quite well. Entry by dollar cost averaging on any retrace toward low $140's.

🚀🚀🚀 Alphabet $GOOGL - BULLISH

Following up on last week's call price did hit our ideal entry point and we are now long and strong. Stop loss has been re-adjusted at break even. There is also an active bullish time at mode trend set to expire by the end of the month with targets of $189 and $201's at first.

🚀🚀🚀 Amazon.com $AMZN - BULLISH

Bullish time at mode confirmed has just been confirmed as well. Long targets of $231 and $253's expiring mid December. Any retrace toward $200 is buy opportunity although it might be a bit too optimistic with current price action strength. We'll be posting any update throughout the week as usual.

Meta Platforms $META - STANDBY

Not much to do here, price did re-tested the low (red line) suggested and has now pumped again but there is no real bullish strength shown from macro timeframes.

For better confluence to go long here price needs to make a new higher high by getting at least a daily close above previous high of $602.

Apple $AAPL - bearish

Last report we posted a long idea which hit our entry but we manually closed the trade with a -1% loss. Price was simply not in our favor and indeed puked.

The weekly chart closed last week with a bearish engulfing bar and a expansion bar #nobueno. As you all can see, now we are having a dead cat bounce. There is no real macro strength in these last two stocks so rather stay out for now.

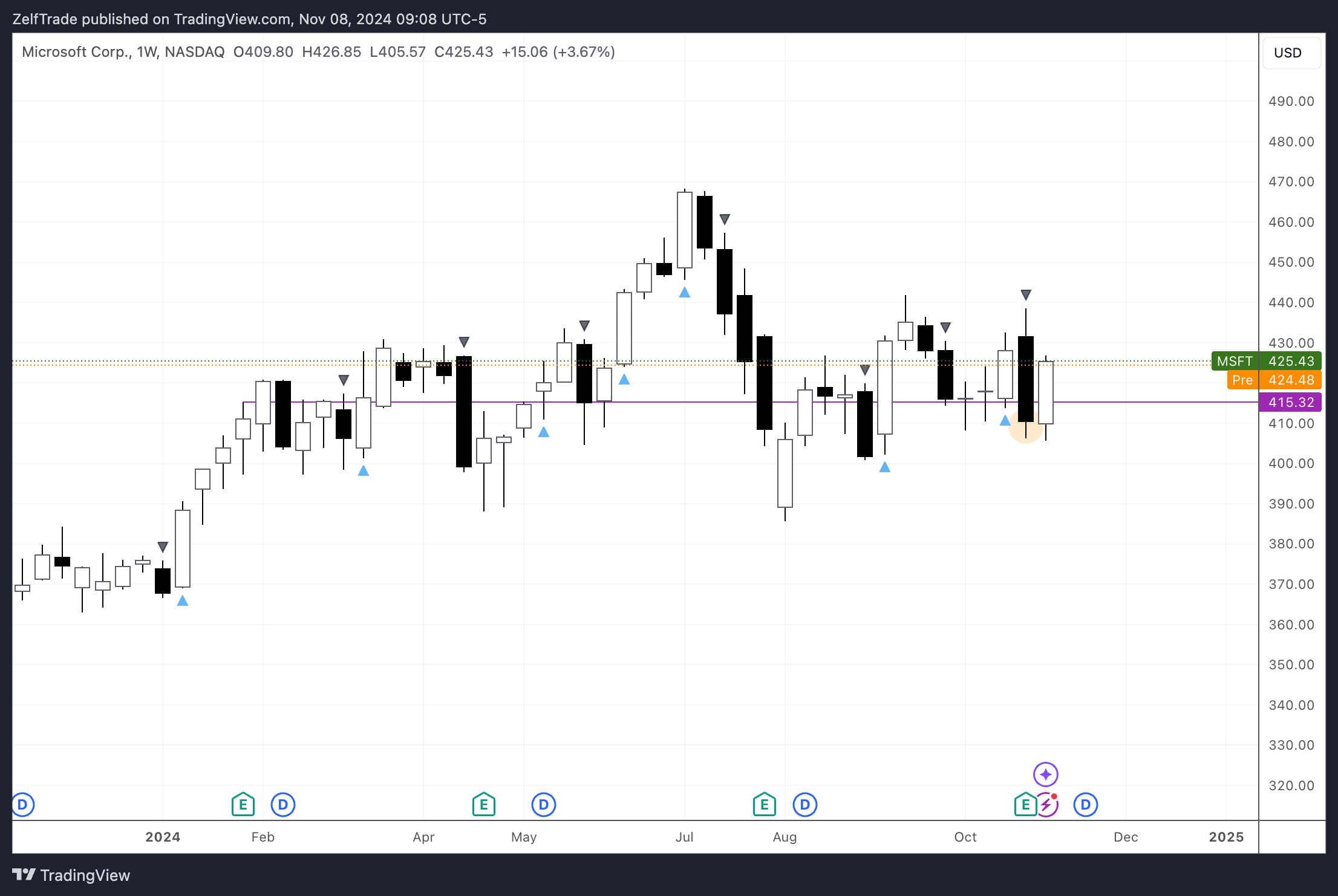

Microsoft $MSFT - bearish

On the same date, October 31st we also posted an update here that we were stopped out. Unfortunately price went completely inverse and we got stopped out at break even. Analyzing the weekly chart this stock has also confirmed a bearish trend and there is no bullish strength as for now so better wait.

Previous report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.