Mag7 Tech Stocks - Edition #15

Bulls are back indeed. Last weekly close of the Roundhill Magnificent Seven ETF $MAGS had another bullish engulfing bar now making a new higher high. So what's next? A short term retrace toward $44's as previously mentioned is still in play, this will be the ideal moment to re-position ourselves in the markets as bullish structure is intact and more than likely we will be heading to $49's in the near future.

Nvidia (NVDA) - bullish

Second leg up confirmed. Patiently waiting for our final target.

Tesla (TSLA) - bullish

Second leg up confirmed and on our way to $260's.

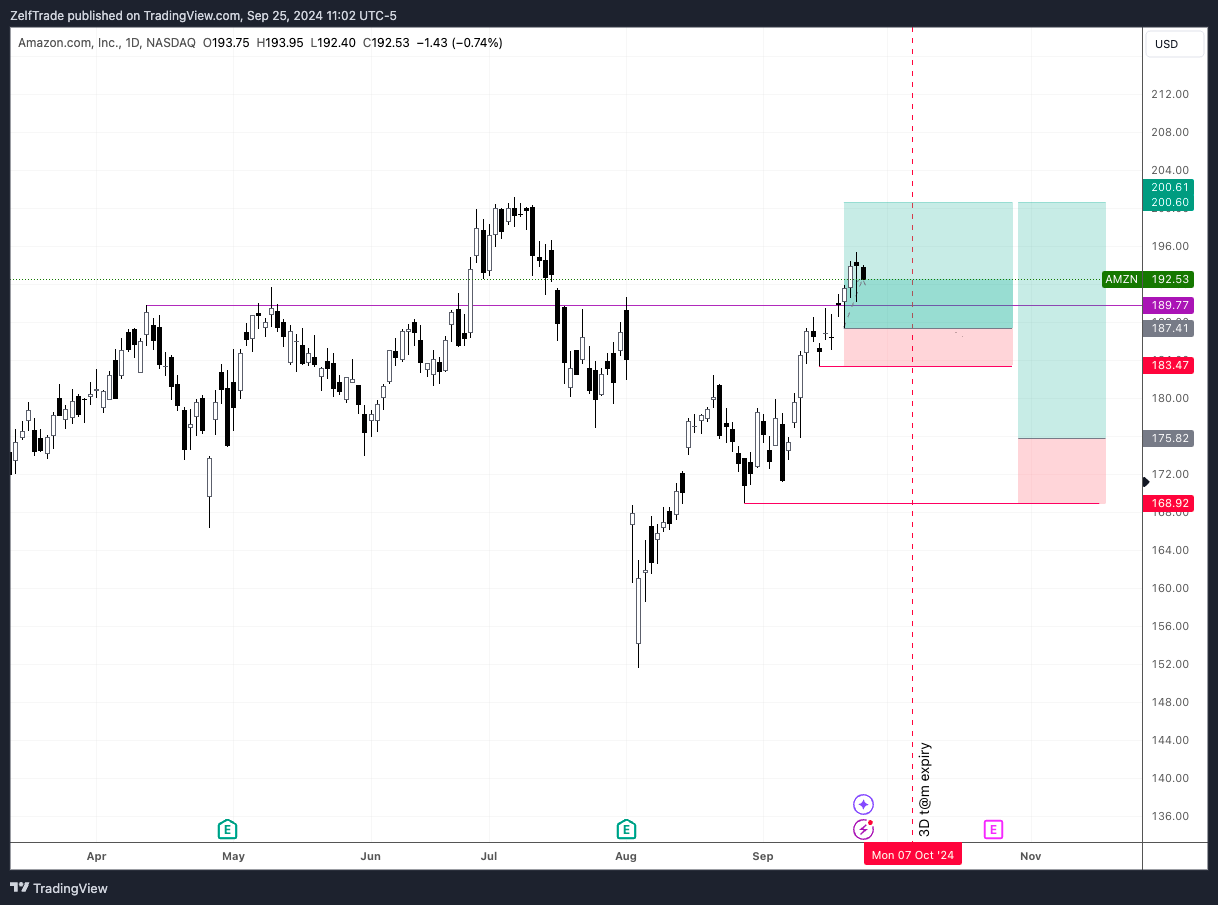

Amazon.com (AMZN) - bullish

Bullish flip confirmed. We have two long entry plays.

Microsoft (MSFT) - bullish

Bullish flip confirmed as well. Ideal long re entry upon a retrace toward $415's.

Meta Platforms (META) - bullish

Extremely bullish and completely missed ideal entry but not jumping in at current price. Rather wait for a better entry. Patience pays off.

Alphabet (GOOGL) - bearish

Bearish structure remains intact. Not jumping in at current prices, either we break above previous highs to enter long or simply wait for a retrace.

Apple (AAPL) - bearish

Nothing to do here. We are at resistance level, either we break above for bullish continuation or we wait for a retrace.

Previous report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.