Mag7 -Ed. #29 / $h!t Has Hit The Fan

FEB 7 REPORT CALLED IT

It’s official—shit has hit the fan. The February 7 report laid it all out, and now we’re seeing it play out in real time. The markets are plummeting, and the drama is off the charts. Inflationary pressures, geopolitical chaos, the Fed’s market manipulation in symphony with higher timeframe price action which showed clear signs of weakness at the top WERE ALL RED FLAGS.

Sincerely hope you all took profits and adjusted your risk like we suggested. If you weren’t prepared, this might’ve caught you off guard. In moments like this is when dry powder comes in handy. Opportunities will emerge as the dust settles but lets be patient.

Previous Macro report below 👇👇

MACRO OUTLOOK'S PLAYING OUT ✅ 🩸

The Roundhill Magnificent Seven ETF ($MAGS) has now dropped -20% since our last update, and the macro outlook we laid out is unfolding exactly as anticipated. The monthly chart showed clear signs of exhaustion: a massive sell-off wick in December, followed by a weak January close. Then, price closed February with a monthly bearish engulfing candle, followed by the huge sell-off we’re stuck in right now.

So, what’s next? In theory, current market levels should be good for a bounce. However, keep in mind that this retrace could easily extend to the low $40's without any issue. Let’s stay cautious and monitor price action on lower timeframes to try and spot any possible signs of a reversal in momentum.

Any short term pump should be treated as an underside retest. Until $49 level is reclaimed and confirmed as support, the broader downtrend remains intact, and bounces should be approached with caution.

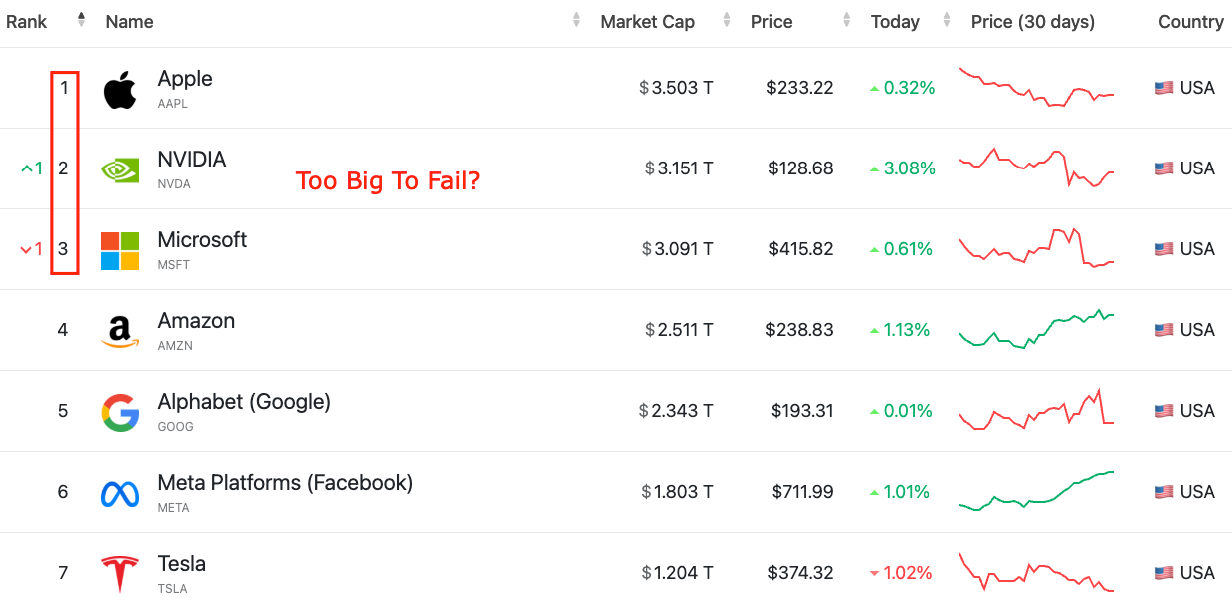

✅ NVIDIA +26% FROM SHORT ENTRY – TRADE ON

The $140 short entry on NVIDIA played out perfectly, and price has plummeted as expected delivering massive gains so far. The bearish momentum remains strong, and the downward path is likely to continue nonetheless taking some profit wouldn't hurt... especially after such a strong move.

If price pumps again toward the high $130s, this could present another short entry opportunity, as the bearish market structure remains intact from a macro and short timeframe analysis as well.

✅ META +21% and +27% PROFIT TAKEN & POSSIBLE RE-ENTRY

Meta’s bullish momentum has completely evaporated. The key support area at $710 failed to hold, and price plummeted as expected. Fortunately, we had already reduced most of our position size, locking in profits at +21% and +27% from our entry as previously updated in our Discord channel.

Price is currently sitting at the $600 yearly open, a critical support level. As long as price remains above this key area, we could see an easy +10% bounce from here. However, let’s remain cautious. Many other big tech stocks are plunging right now, and Meta could easily get dragged down with the rest of the sector.

✅ APPLE +12% PROFIT TAKEN & STANDBY

We’ve successfully locked in a +12% profit from our Apple trade, taking profits near the $250 resistance zone as suggested in our Discord. Now, the question is: what’s next? I’d like to think the $220's should act as support, but given the ongoing signs of weakness in price action and the bearish macro environment, there’s a real risk price could slide through to new lows.

The macro outlook remains bearish for now, and Apple isn’t showing enough strength to justify rushing into a new position. For this reason it is a standby for now. There’s no need to force a trade here, as there’s not much confluence or clear momentum to work with.

✅ AMAZON +4% AVG PROFIT TAKEN & STANDBY

The Amazon trade idea has been invalidated. While the trend initially looked clear, with price making higher highs and higher lows, recent price action signaled weakness as it swept the lows at $116. As posted in Discord, this breakdown indicates a loss of momentum and invalidates the bullish structure we were anticipating. If you look at the chart, the uptrend was clear. Multiple higher highs and higher lows. But oh well, nothing goes up forever.

Took a -2% loss ❌ from the re-entry point mentioned in our previous post. But did locked in small profits along the way, taking some off at +6% ✅, which helped mitigate risk and secure gains.

Macro remains bearish for now.

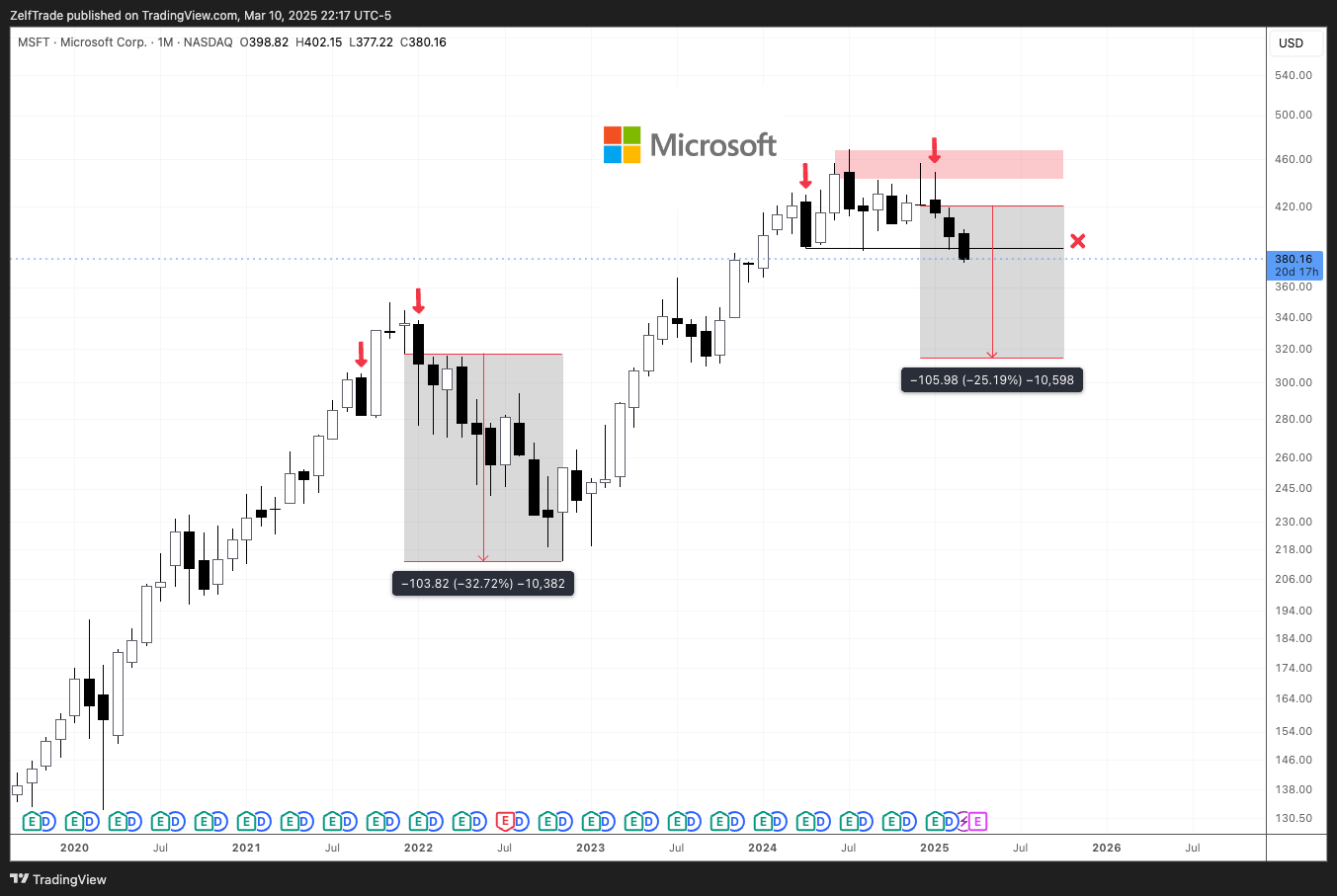

MICROSOFT PURGE HAS BEGUN

The purge is officially underway as price sweeps the range lows and looks poised to head toward the low $300s. The monthly chart’s bearish engulfing candle—a pattern last seen in 2018 and 2022—perfectly gave us the warning sign. Both previous instances were followed by substantial pullbacks, and now everything suggests history will rhyme.

From a macro standpoint the low $300s are now in play as the next potential support area. There’s still no compelling reason to consider macro long positions. The bearish structure remains intact.

TESLA STEEP RETRACE – LONG-TERM OPPORTUNITY AHEAD

Well, I wasn’t quite expecting such a steep retrace this quickly on Tesla, but here we are. This move sums up the current market sentiment, everything is holding by a thread. But hey! Despite the short-term pain, Tesla remains one heck of a stock to hold for the long term. If price continues to dump toward the mid $150s, that could present an ideal re-entry point for those looking to add or scale in.

GOOGLE TESTING $160 SUPPORT

Google is currently testing the $160 support level, a critical zone we’ve previously discussed. While the bearish momentum remains firmly in control, this level could spark a short-term bounce if buyers step in. We could see a short-term bounce, but don’t mistake it for a trend reversal. The broader market structure remains weak.

Previous report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.