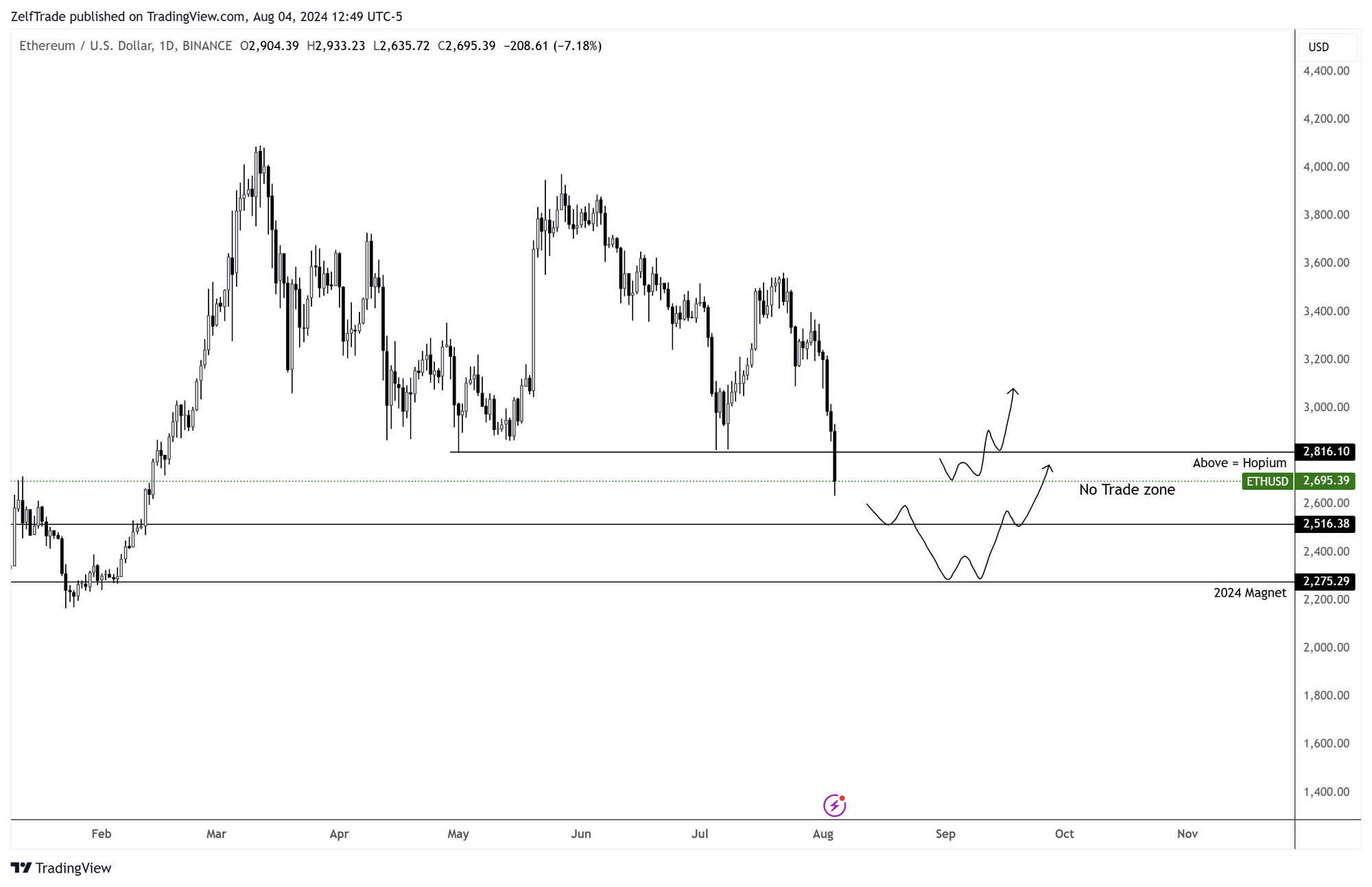

Ethereum (ETH) - Edition #2

Possibility of triggering a massive downtrend.

Based on previous observations. Ethereum has failed to outperform bitcoin since early 2022. As of last week, it had the best chance to make a comeback on the technical side of things with both usd and btc charts sitting in crucial areas for a trend reversal or at least a bounce. With continued selling pressure and a possible bearish signal for August, Ethereum will most likely continue to disappoint throughout 2024.

August is turning out to be a messy month for cryptocurrencies, can it get much worse?

As it blew past $3050, the price zone that was expected to hold for the trade setup in the previous post. It is now in no man's land. It will be logical to bid at these prices for a strong deviation play, as it just took equal lows in the range low that has been building all year, but waiting for price reclaims after strong sell-offs rather than bidding blindly is the way to go.

- Above $2900 will be a good place to start buying.

- A positive reaction at $2270 will be a mean reversion play

If this month's price action hits $2495.69, start handing out resumes and focus on something else for the rest of the year.

Ethereum's gloomy side:

- Showing downtrend on both charts but with more bearish momentum against Bitcoin.

- Price confirmed a new monthly downtrend that will expire in May '25

- Bi-monthly signal active since July '23 and will expire in January '25

Technicals are pointing bearish against Bitcoin for the rest of '24, but keep an alarm in case it decides above 0.05359, as a big long setup may be executed. This is a big "if".