Commodities - Update 19

Shit's going crazy in the stock market and metals have recovered bullish grounds. Will this be the beginning of metals bullish run?

Bullish thesis confirmed on Gold $XAU as price just broke previous highs. Now there's two scenarios:

1/ $2,750's is the bottom. Pump from here.

2/ Price breaks below $2,750's and gives a better chance to position ourselves.

Silver $XAG - NEUTRAL/BULLISH!

Lagging behind but starting to show strength as well. Price has currently pumped to resistance. Risky jumping in right now. Any retrace towards $31's should be a buy. Price needs a strong close above $33 for further bullish confluence.

Natural Gas $NG1! - MACRO BULL

Chart has finally retraced to our previously mentioned weekly buy area. Do keep in mind price may continue to retrace toward mid $2's which will be the ideal entry area for a macro long. There is a huge fair value gap/unbalanced zone to the upside which is a DONE DEAL in terms of target.

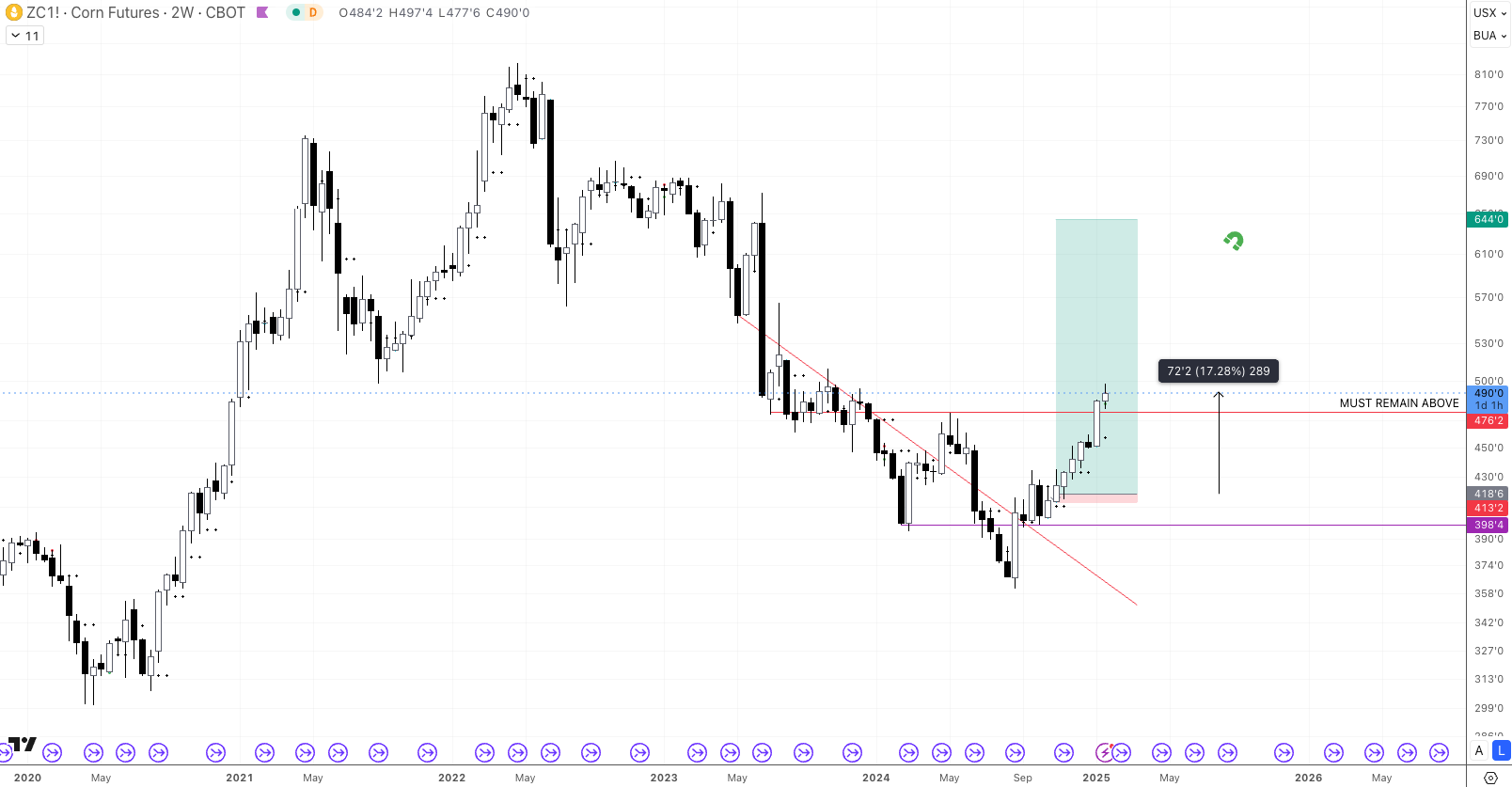

Corn $ZC1! - MACRO BULL

✅ +17% IN PROFIT here! As long as price remains above the red support line we should be good for further upside and on the other hand, any closes below this level and price might be getting ready for a retrace. Will be keeping close attention to this one.

Sugar $SB1! MACRO BULL

✅ +22% PROFIT from last post short idea...!

Now what? Alright so in theory the latest low could and should hold but at the same time I wouldn't be surprised to for price to sweep the lows and reclaim back above before further upside. This will be the ideal scenario actually.

Oil prices settle as US stockpile grows. Trump clearly stated that he will be growing their supply. Will this actually have such a drastic effect on Light Crude Oil $CL1 ? Any retrace toward $60's should be a buy at least for a swing trade as chart already started to show strength.

Previous Report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.