Commodities - Update #13

Yeah yeah gold bugs everywhere now. With the current economic uncertainty and the money printing going brrr why not be a gold bug?

Gold (XAU)

Extremely bullish close last week with a bullish engulfing bar closing above previous highs and making a new all time high. From a macro standpoint, any retrace towards high $2,600's is a buy opportunity.

On shorter timeframes we have now a bearish daily engulfing bar signaling a possible retrace short term. In confluence with our macro analysis, short term's also pointing at around $2,670's.

Silver (XAG)

With not a strong of a weekly close compared to Gold but still bullish, price here also closed with a bullish engulfing bar making new highs. Any retrace toward $32's is a buy opportunity.

+6% profit from small market buy after break and price perfectly hit our target. Short term's also looking like a retrace might be on its way and pointing mid $32's.

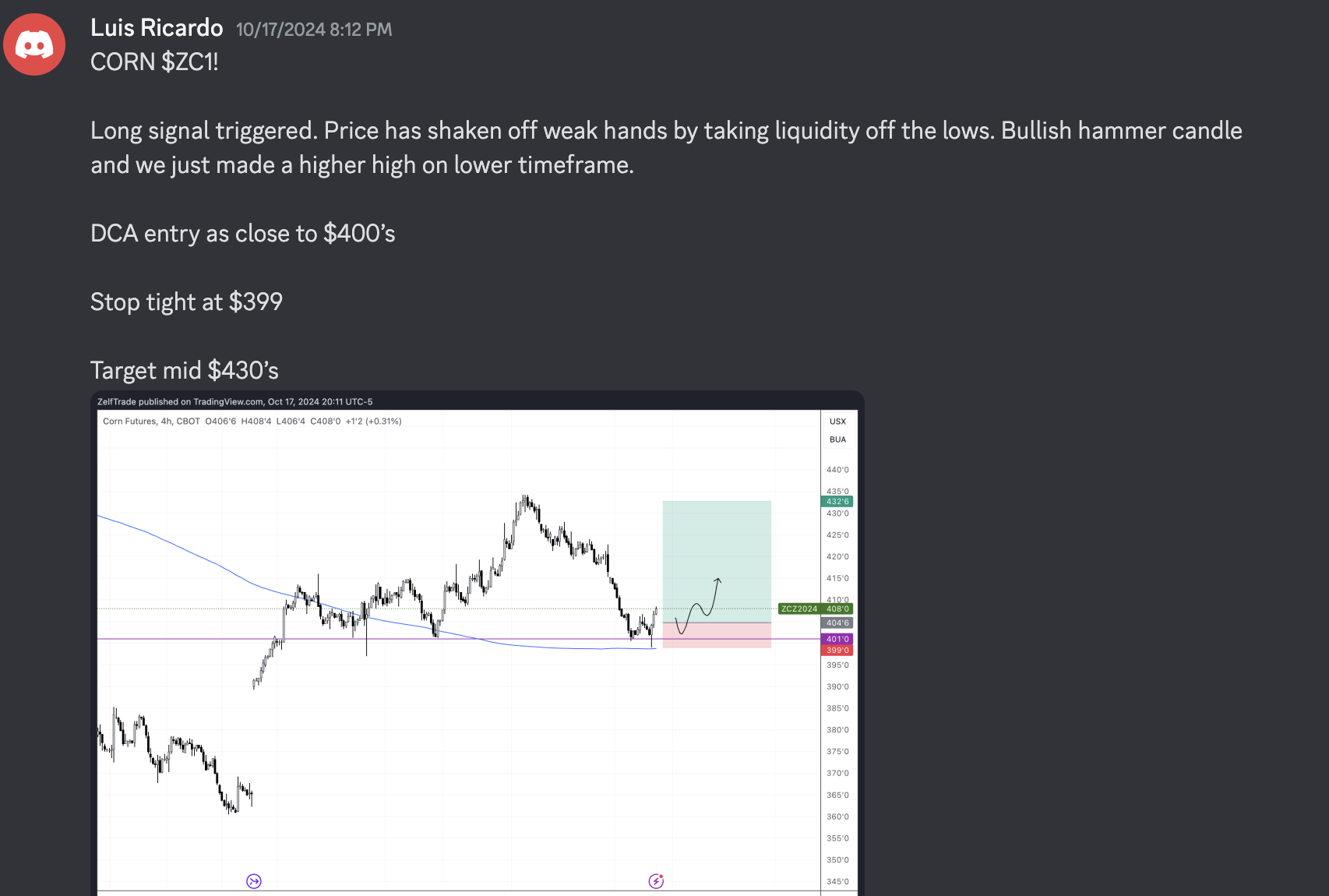

Corn (ZC)

Last week we posted this trade idea on our discord channel.

Price reacted quite well, and currently in profit.

Wheat (ZW)

-1.8% stop loss hit as we had a clear rejection of our must reclaim area and price simply puked straight down. As for now its looking like it might have found a temporary bottom but there's no rush in jumping in right now. Rather wait for price to reclaim above $595 in order to have more certainty in direction.

Previous report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.