Back to the future syndrome

The influence of the immaterial

Summer of 1985 will always be remembered as one of the most important seasons in science-fiction film history after the movie Back to the future -written by Bob Gale and Robert Zemeckis - became a instant success. The idea of the film was first conceived in 1980 and after getting rejected 40 times by various studios, they finally secured a development deal.

After going over budget by USD $4M, they finally completed the film just under the USD $20 Million, at a time where 7 figures actually meant something. The film earned USD $15M on its opening week and was the number one film for eleven of its twelve first weeks. By the end of its theatrical run, it earned approximate a box office gross of $210.6 million in US and Canada, and $170.5 million on the rest of the world. The film managed to 20X the original investment in a matter of a few months, figures that make any "crypto bro" blush.

In one of the most iconic scenes of the movie, Marty McFly runs into trouble in the same cafe which he frequents throughout the movie, but this time in 2015. After running away from the cafe, McFly encounters hover boards, electronic extendable baseball bats and even a self-drying jacket, which automatically turned on after McFly dropped in the city pond.

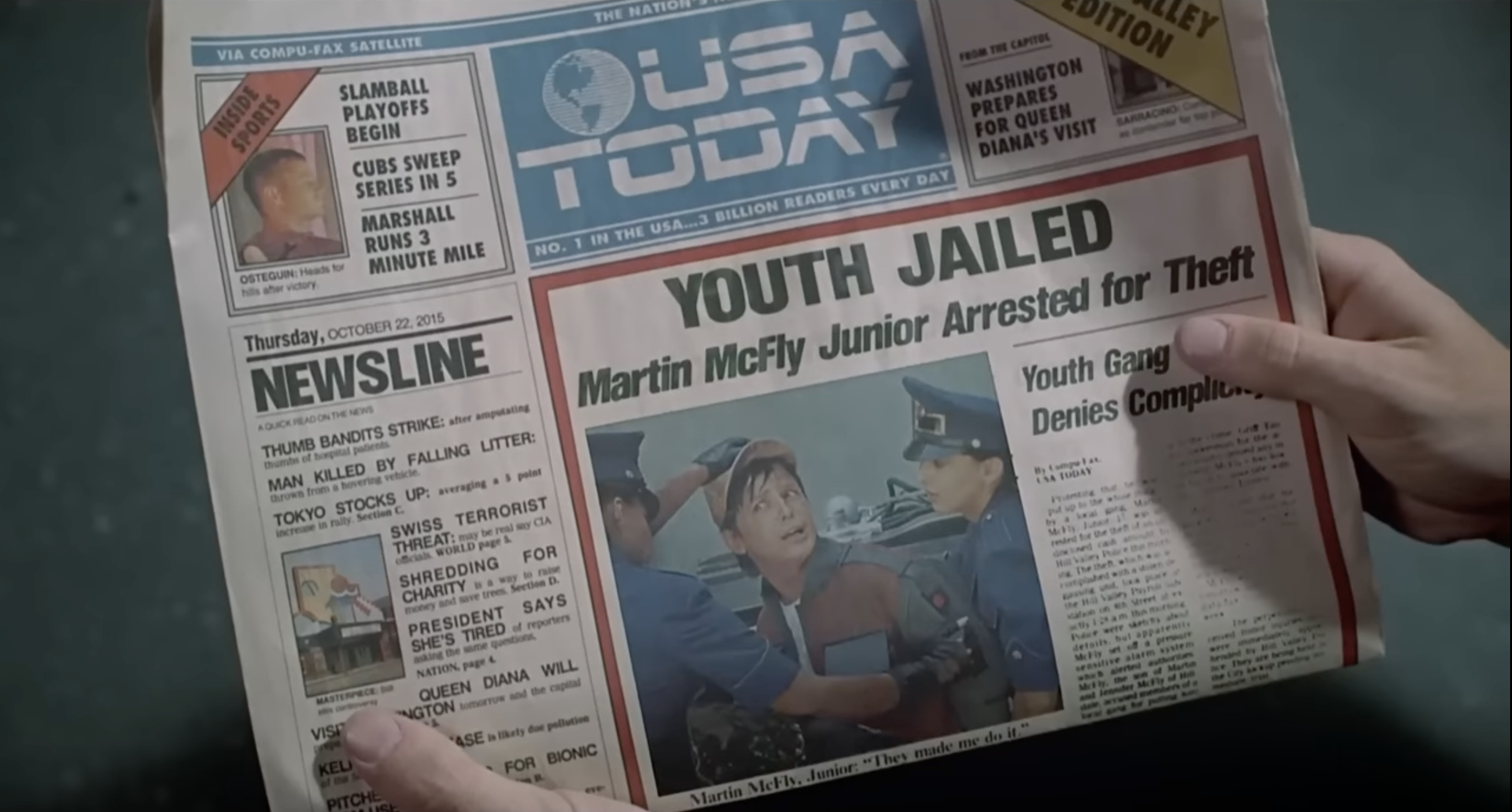

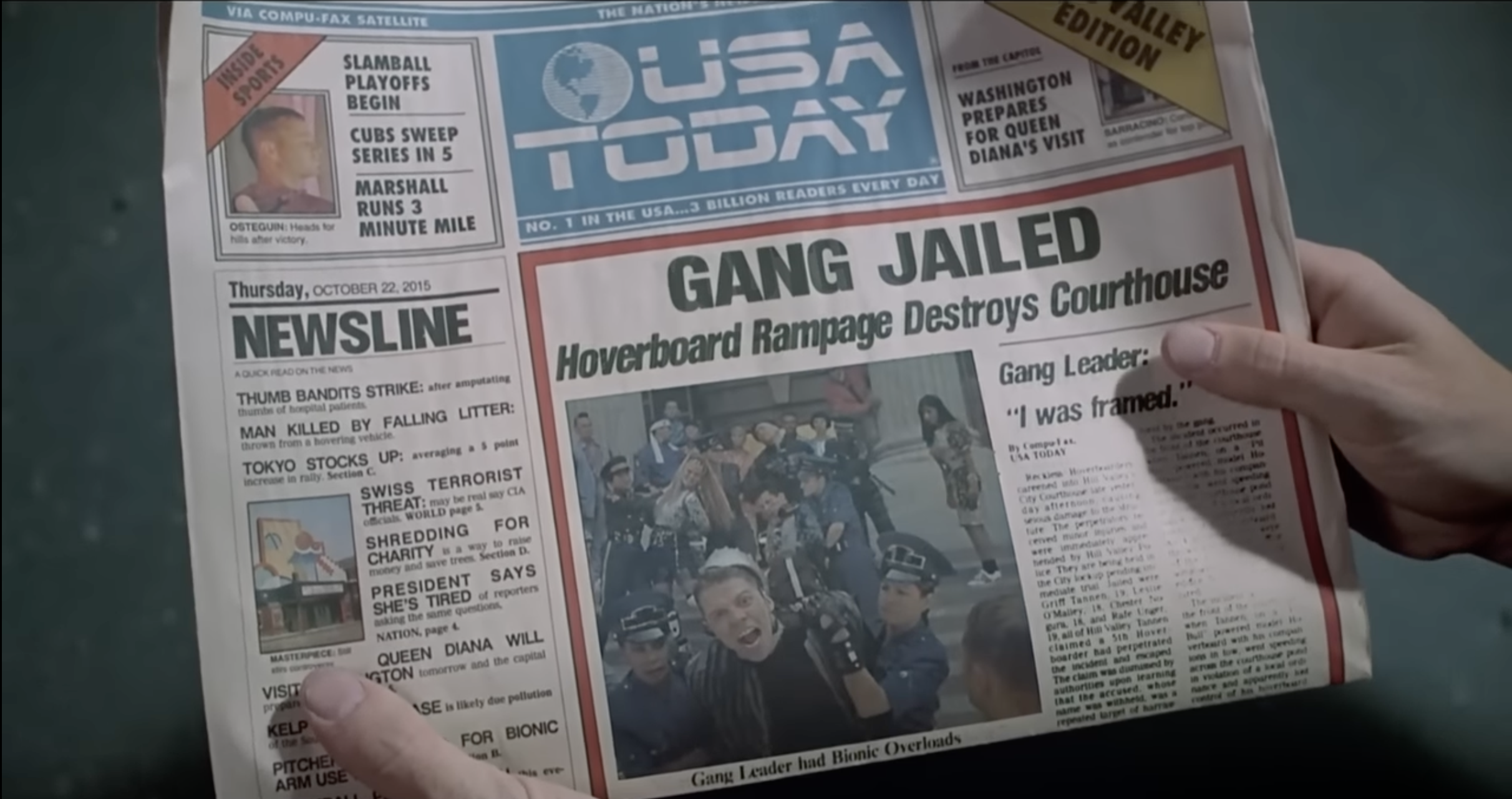

After escaping from a group of cyber bullies, McFly runs into Emmett "Doc" Brown, who is driving the iconic DCM DeLorean. Doc gets stressed out after realizing that McFly changed the outcome of the future after his unexpected influenced of a crash of the cyber bullies with a government building, to which McFly responds, "Doc, Doc, Doc... look at this (newspaper), is changing."

Back in 1985, when this movie played out, people envision a future in which technology will disrupt industries in the transportation, sports an even clothes industry, but they never envisioned a world in which the internet would wipe out the newspaper industry.

The future of 2015 came to pass and hundreds of towns and communities of Canada and Norther US, who depended on paper productions to sustain the pulp/mill/forestry industry, suddenly realized that all the predictions made in a Back to the future were off not by just a mile, but by a few standard deviations.

This gives us insight on how narrative (in this case in the form of fiction) and the mind (both immaterial in essence) can fool an entire generation of people, or what I would call the Back to the future syndrome.

From McFly to McDonalds

January 1990 marked a historic triumph of the free market over statism, not because of the fall of the Berlin Wall, but precisely because one of the most iconic capitalistic brands in the world opened its first branch 12 months before the Soviet Union was dissolved.

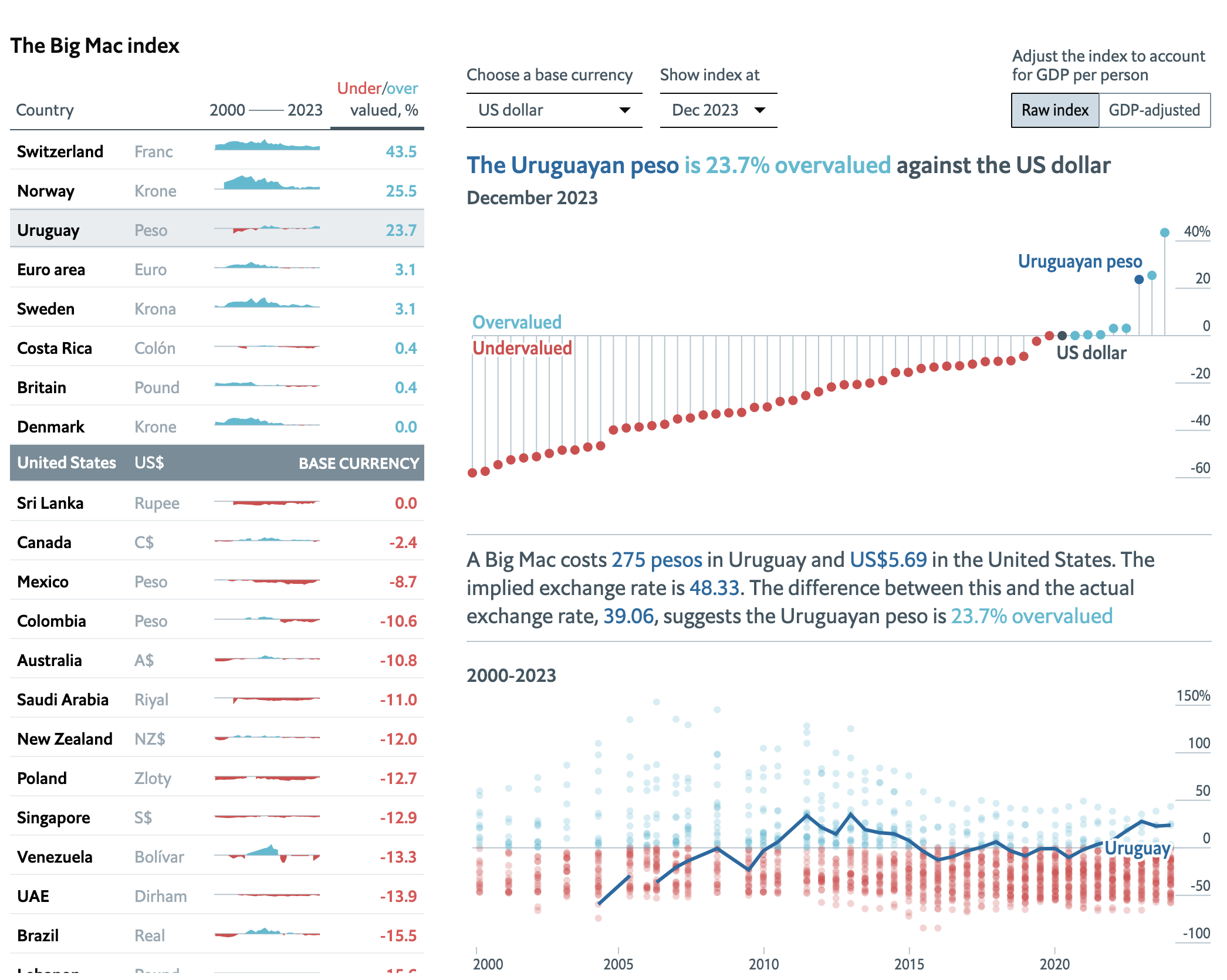

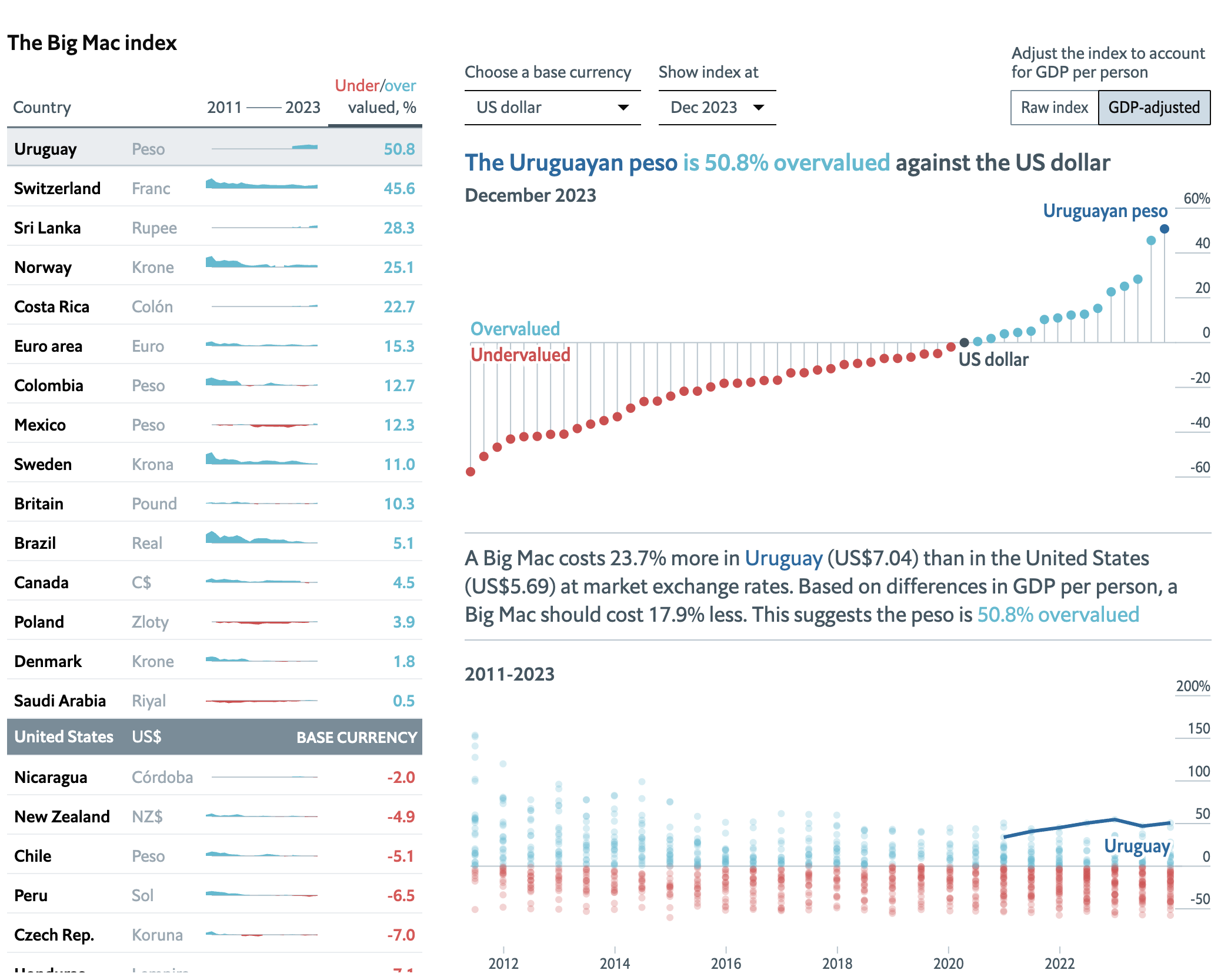

McDonalds, not only is known as one of americas most iconic food staples but it is also recognized as a gauge of the logistics efficiency and purchasing power for every local economy. This is one of the reasons why in 1986, The Economist first introduced the Big Mac Index, which tracks the price of a McDonald's Big Mac cheeseburger in each country, thereby offering a quick and easily country-to-country comparison of purchasing power parity (PPP) and currency values all over the world.

As portrayed on the above graph, in nominal price, a Big Mac is more expensive in 8 different jurisdictions across the world as compared to the US.

However, if we check the GDP-adjusted pricing we actually find that 15 jurisdictions (including 20 nations with Euro currency) rank more expensive than the US. Uruguay's Big Mac ranks 50.8% more expensive than in the US and the index clearly shows that a Big Mac is actually less affordable in 34 out of the 71 countries surveyed. Let me point out that The Economist put the Euro Zone as a region surveyed, where 20 nations shared the same currency, so this means that 47% of the nations surveyed have a Big Mac index higher than in the US.

The story could be over now, if we were willing to bow the knee to the wannabe-Xerxes of today, the e-CON-omist who believe in the false ideology of Keynesianism and MMT (monetary based theory) or what George Gilder would politely call Materialistic Economists. However, there is more.

Die Zeit

On one of my recent reads, Life After Capitalism, George Gilder (in my opinion, an the most undervalued economic mind in modern times) makes the case that in the book Das Kapital. Kritik der politischen Ökonomie (English: Capital: A Critique of Political Economy), as its title implies, Karl Max makes a thesis that is both reductionistic in nature and philosophically wrong. Marx's claim is conceived from a materialistic school of thought, where nothing exists except matter and its movements and modifications, therefore, it is easy for him to conclude that wealth is uniquely the accumulation of capital. However, the reality of life hints that we live in a world beyond materialism, which clearly is observed on a free market economy, where products/services are not the product of spontaneous acts of randomness as the darwinian fairy tales of academia would like you to believe, but instead, a product/service is conceived in the mind of the entrepreneur. The immaterial mind, impossible to be reduced into the scientific method of testing and experimentation, is the one in charge of creating the free market economy that all beloved e-CON-omist missed to account.

The human mind (The Greek word for mind is nous, which means a whole process that includes not only the conceptions of an idea, but also its fulfillment) is not only the epicentre of the economy from which it stems the accumulation of knowledge into innovation, giving fruition in the free market, but it also answers the evolutionist enigma of how we as a species came to full consciousness in our current state of 'Homo Sapiens Sapiens'. The human mind is the immaterial missing link of evolution that differentiates our readers from a species that resembles us not only in anatomy, but that shares 98.8% of our DNA, the chimpanzee. However, for modern academia, the institution who dares to explain our dualistic reality (material and spiritual) only from their materialistic idolatry, has come to make the works of the serpent of old, who has managed to deceiveth the whole world.

Academia would be forgiven if they only had managed to missed the influence of the immaterial in economics and the origin of men, however, they also missed it in price measurements. Gilder through his investigation, brings to light the works of William Nordhaus, Julian Simon, Gale Pooley and Marian Tupy, all who contributed to what is known as time-price revolution. As Gilder explains:

The actual price we pay for anything is not best expressed by manipulated government money and sloppy inflation adjustments. The real price is the amount of time it takes to earn the money to buy goods and services. When we spend money, we are spending our time, the time it took us to accumulate the money.

Additionally, Gilder divorces economics from materialistic ideology by emphasizing that wealth is actually the accumulation of knowledge.

Wealth is knowledge measured by money as time, which is what remains scarce when all else grows abundant. Time is the ultimate measuring stick of productivity, economic value, and abundance.

Capitalist theory, from Adam Smith to Karl Marx, was built on the reductionist view of materialism, which is the same pedestal that sustains the god of this age, statism (any type of government that doesn't put the individual first). Academia has sold out to the materialistic claims that the economy consists of labour rather than the entrepreneur's mind, of accumulated capital rather than accumulated knowledge—that people are consumers rather than creators, conditioned animals rather than man created in the image of God.

Accepted academia missed to measured and represent the economy with a standard that is both objective and timeless.

Consumers - Not Lovin' It

Referring to the Big Mac Index, The Economist presented the price of a Big Mac in both nominal terms and GDP-adjusted prices. These price expressions became prominent following the collapse of the Bretton Woods System in 1971, a metric necessary in the present fiat system, which by natured is flawed, subjective, and ultimately worthless as the notion of the value of time is not represented. As the famous French writer Voltaire once said, "Paper money eventually returns to its intrinsic value: zero".

Unlike money prices, time-prices are unequivocal and universal. All other prices are circular, measuring value by measured values, commodities by commodities, market caps by money markets, while time-prices recognize that money is merely the device that enables the scarcity of time to be translated into transactions and valuations as tokenized time. Outside of that inescapable reality, prices are subjective. The time-price measure transforms—and clarifies—nearly all economic calculations and assumptions, from the rate of economic growth to the weight of debt to the degree of inequality to the impact of atmospheric carbon dioxide to the level of true interest rates. - George Gilder, "Life After Capitalism"

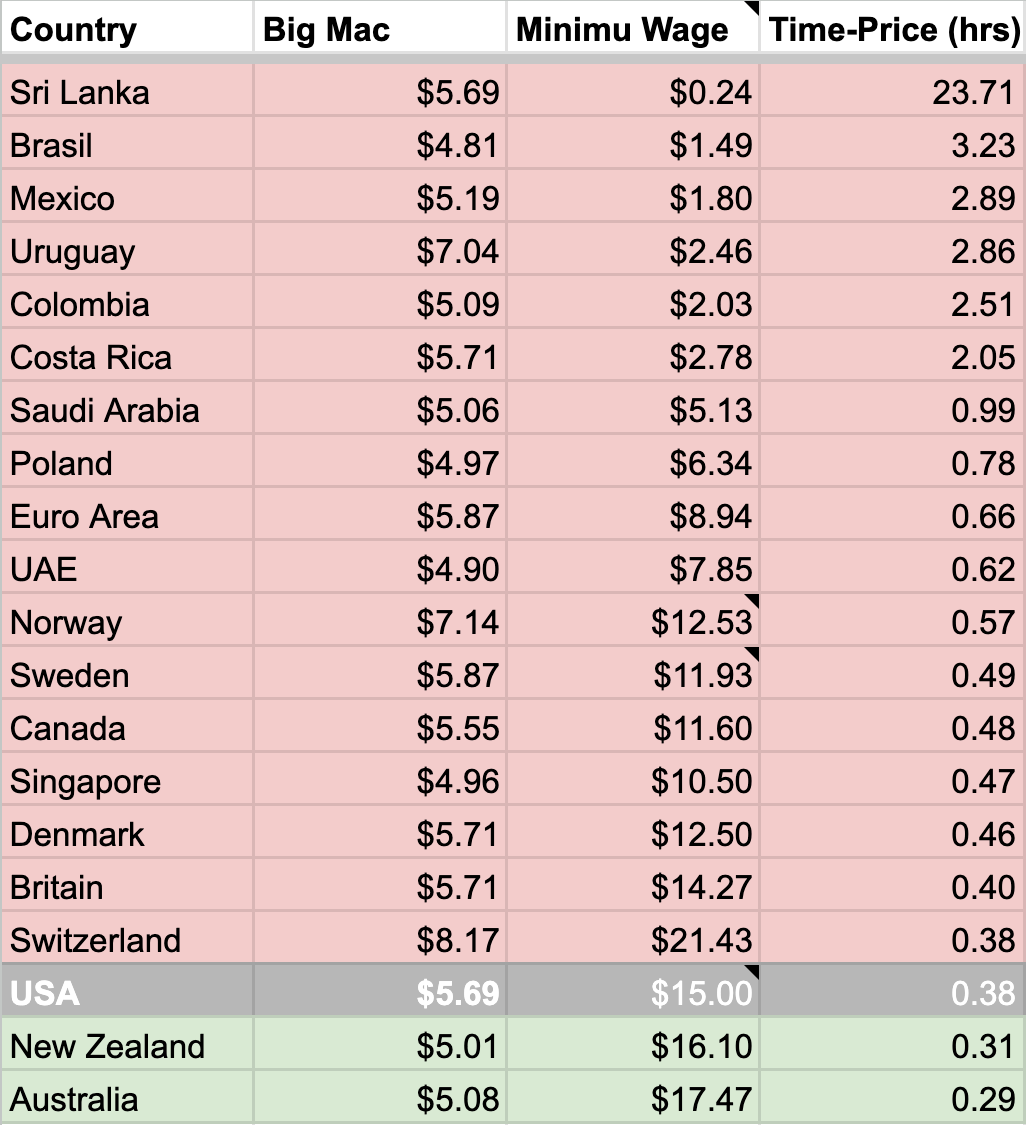

Let's then apply a time-price standard to the Big Mac Index based on the Raw Index.

Note: The above Time-Price was measured taking in account the minimum wage for each nation or the minim wage of hospitality/food industry, excluding income tax.

Not a surprise for people who have a passport and have travelled outside the anglo saxon world, the data shows that only two countries of the originally surveyed have a better Time-Price than the US and the rest of the nations rank poorer in Time-Price standards. This in essence is a real radiography of the Big Mac Index with a global standard that can is consistent through space and time.

A peculiarity to highlight, not in the data itself but in the delivery of it, is the fact that The Economist utilices green color for overvalued Big Macs as if overvalued assets were good for the working class. They seem so preoccupied to push a positive narrative of their fiat based propaganda to the point that they invest more effort on choosing the 'narrative colors' than on correctly presenting an affordability index that reflects a economic reality. This reminds me of the modus operandi of another propaganda, "global warming caused uniquely by men's emission".

This propaganda birthed from the sect (can't event call it a religion) of political-scientism, built on the premise that politicians, the same people who have not solved wold hunger or the collapse of birth rates, somehow will save the planet and humanity as a whole from the "impending catastrophe" caused by the whopping 0.04% of CO2 in the atmosphere.

But enough with similarities between mainstream propaganda and let's continue with McDonalds.

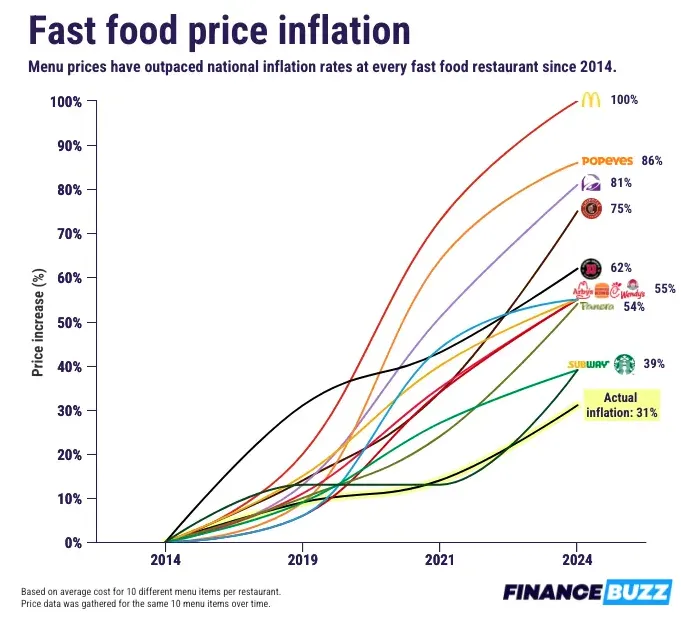

Let's now dive into the McDonalds earnings call. As of the date of this writing (July 24, 2024), McDonalds has only published their Q1 Results for 2024. Needless to say, the consumer is becoming more conscious of their buying habits specially since McDonalds has had the highest inflation in the last 10 years.

As DEE-ANN DURBIN from the Associated Press puts it:

The Chicago burger giant said inflation-weary customers are eating out less often in many big markets. In the first quarter, fast food traffic was flat or down in the U.S., Australia, Canada, Japan, the United Kingdom and Germany. “The consumer is certainly being very discriminating in how they spend their dollar,” McDonald’s President and CEO Chris Kempczinski said Tuesday during a conference call with investors. “It may be more pronounced with lower-income consumers, but its important to recognize that all income cohorts are seeking value.” In the U.S., same-store sales rose 2.5% in the first quarter, but that was largely due to price hikes carried over from last year.

McDonalds is just beginning to experience an increase in time-price which is deterring lower-income consumers. This unfortunately is not unique to McDonalds but to the global food industry.

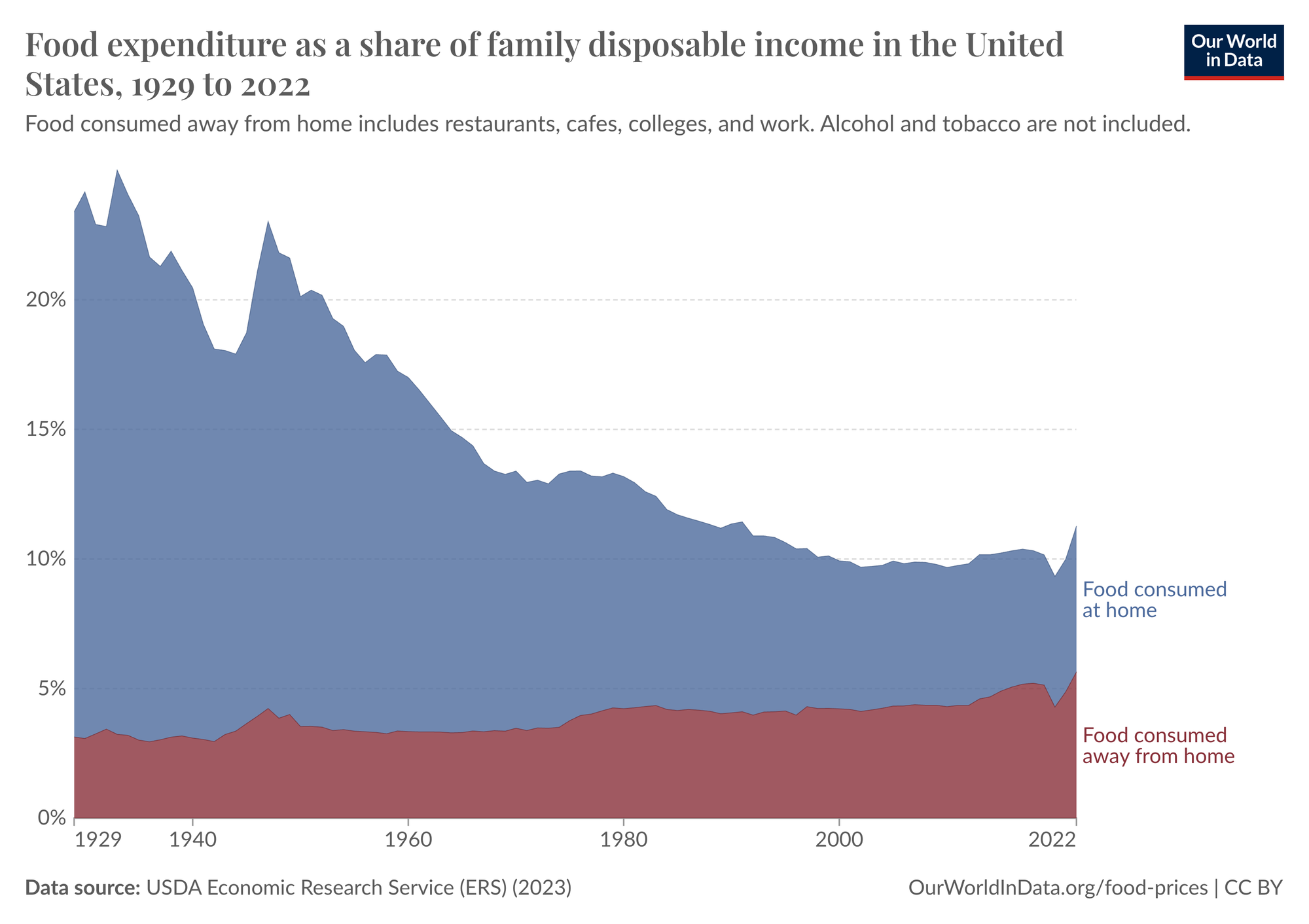

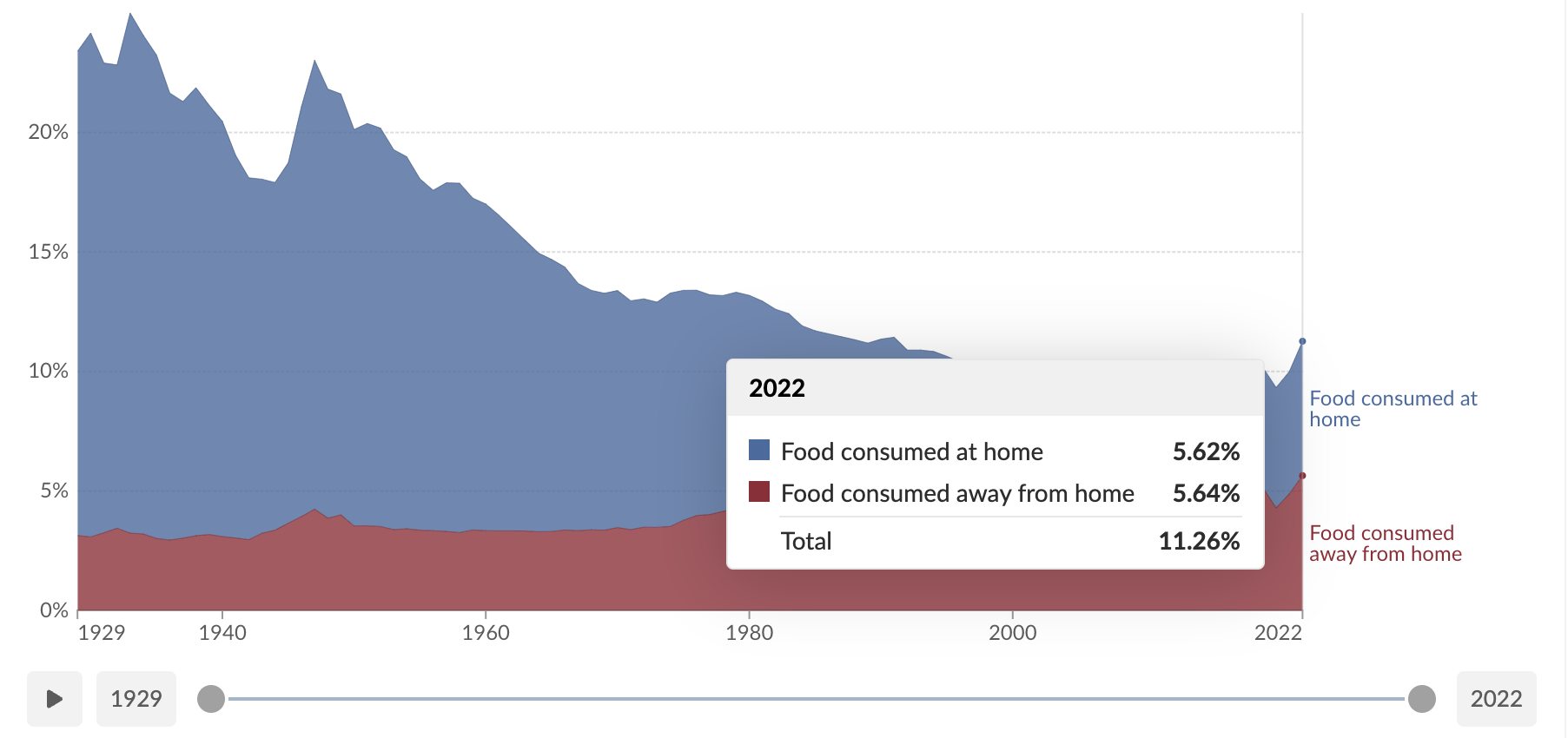

The USDA ERS in their most recent data, which strangely enough stopped being reported since 2022, the food-to-disposable income percentage reached 11.26%, a significant spike which gives room to my thesis:

We are at the beginning of a reverse to the mean of a 100 year chart.

By looking at the charts, no one (e-CON-omists, traders or gamblers) would bet that the percentage of food per disposable income will ever try to do a reverse to the mean, let alone reach the levels of 21.77% from 1933. This is because as a collective society we all have the tendency to suffer from Back to the Future Syndrome, where we assume that legacy industries such as the newspaper or the industrialization of food production, which we as a civilization have mastered by the means of our accumulated knowledge, will continue to exist for generations to come as the reality that we know today.

This is analogous to a recent event in history, the Japanese Holdout. After the surrender of Imperial japan which marked the end of WW2, soldiers of the Imperial Japanese Army and Navy continued fighting. More than a dozen people continued to fight from 3 up to 29 years after the end of the war. People have come up with different theories of why the Japanese holdouts lasted that long, explanations range from soldiers doubted the veracity of the formal surrender, were not aware that the war had ended, feared they would be killed if they surrendered to the Allies, or felt bound by honor and loyalty to never surrender. All these possible reasons stem from one single source of the immaterial; information.

Back to the Future or Past?

Back in 2016, I attended the Gold and Silver conference of Vancouver, BC. The place was packed with retail investors, speculators and obviously culebreros (Colombian-spanish for snake oil sales man). Among them there was a guy with a stand who had the audacity to claim that the price of silver was going to rise to $100 USD before year's end. He made a prediction that silver would increase 610% in a matter of 11 months, something not even street culebreros would dare to say.

As we know predictions can even make or break the reputation of a writter of e-CON-nomist, however, when the urgency of the matter outweighs the risk of putting the reputation on the line, the answer is very clear.

McDonalds has been one of the most successful business franchises in the world by a far cry. They employee 2M people under their franchises and 150,000 directly employed by McDonald's corporation. In 2023 they had a Revenue of $23.5 Billion and as of July 2024, they have a market cap of $161 Billion. They are bigger than IBM, Phillip Morris, American Express, Bank of China and even Goldman Sachs. Since 1968, their stock only had 14 years of black candles/negative returns. They have a net margin of about 30%, so it is arguably one of the best run companies in the history of the world.

McDonalds will drop in market-cap by 50-90% before 2030, not because of:

- Bad management

- Accounting scandals

- Fraud the likes of Enron

- The end of the USD

- Nuclear war

- Banning of ground beef (although the extreme left would love to do that to "save the planet").

- Probably not even a reverse to the mean of food-to-disposable income

The reason is more subtle than you think.

Scientist and biology evolutionist have ponder about the parameters or factors for the origin of the universe and the synthesis of the first protein molecule. They have come up with theories that only can be conjure up with a cocktail of psychedelics or by mental gymnastics pushing the limits of rational statistic (as exposed in The Devil's Delusion by David Berlinski) to deny the existence of intelligent design.

The beginning of the universe, the first protein synthesis, the first industrial revolution, the peak of the Cold War with the landing of the moon, the upcoming collapse of McDonalds and even the second return of Jesus Christ (2 Peter 3:10) all have something in common, they're all the manifestation of the immaterial, or in terms of Claud Shannon, the father of information theory, by surprise.

The readers would probably ask, what type of event will be so significant and so damaging to the economic model of McDonalds and the entire global food industry that it will bring a collapse of 50-90% of McDonalds valuation? Fortunately the surprise conveys enough information even in terms of time-price money.

“A quart of wheat for a denarius, and three quarts of barley for a denarius, and do not harm the oil and wine.”

The quart is choinix in Greek, which is roughly equivalent to our present quart, the amount of grain that a normal man needs each day to survive. In ancient times, though, a denarius, the equivalent to the wage of a day's labour, would buy eight to ten quarts of wheat, not one.

This verse predicts an event of global scale and the extreme increase of time-price specifically for food, something that in statistics is considered above a 8 Sigma event or 1 every 803 Trillion days. This is something that can only be intentional be forged or commanded from the spiritual into the material, something that the materialistic ideologues cannot comprehend.

A biblical event of this magnitude is something that no society is prepared for, especially one suffering from Back to the future syndrome.

Johan Castellanos

In the beginning was the word - the entropic bit.